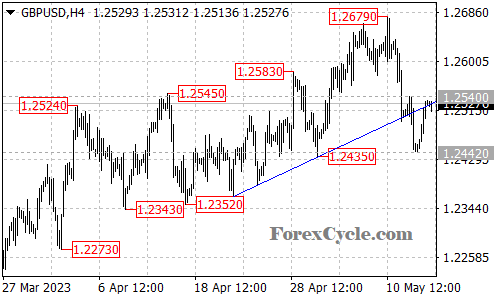

The GBPUSD pair recently experienced a failed attempt to break below the support level at 1.2435 and subsequently rebounded from a low of 1.2442. The price action suggests that the pair is currently facing resistance at the 1.2540 level.

As long as the 1.2540 resistance holds, the bounce from 1.2442 could be seen as a consolidation phase within the overall downtrend from the high of 1.2679. This consolidation suggests that the bears still have control over the market, and another potential decline towards the 1.2435 support level is possible. If the pair breaks below this support, it could trigger further downside movement towards 1.2350, followed by 1.2280.

However, it’s important to note that on the upside, a breakout above the 1.2540 resistance level would indicate that the downward movement from 1.2679 has potentially completed at 1.2442. Such a breakout would signal a shift in market sentiment and could lead to another rise in the GBPUSD pair towards the 1.2700 level.

Traders should exercise caution and closely monitor the price action around these key levels. The GBPUSD pair is currently in a delicate position, with the resistance and support levels providing crucial guidance for future market movements. While the current bias suggests a potential continuation of the downtrend, a breakout above the resistance level could introduce a bullish scenario.

As always, it’s important to consider other market factors, such as economic data releases, geopolitical events, and market sentiment, which can significantly influence the currency pair’s movement. It is recommended to use appropriate risk management strategies and seek additional analysis to make informed trading decisions.