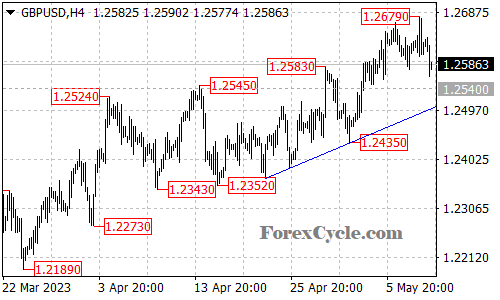

GBP/USD remains under pressure, as the pair continues to test a key support level at 1.2540. A break below this level could trigger further downside movement towards the rising trend line on the 4-hour chart, currently near the 1.2495 area. Below the trend line support, the next major support level is at 1.2435.

If GBP/USD breaks below these support levels, it will indicate that the upside movement from the March low of 1.1802 has completed at 1.2679 already. In that case, the pair could see a further decline towards the 1.2200 area.

On the other hand, if the pair manages to bounce off the current support level at 1.2540, it could retest the resistance level at 1.2679. A break above this level could lead to further upside movement towards the 1.2800 area.

It is worth noting that GBP/USD has been in an uptrend since the March low of 1.1802, and the current pullback could be seen as a correction within this uptrend. As long as the pair remains above the trend line support, the uptrend could still be intact, and a rebound towards the upside could be possible.

In the short term, traders should pay attention to the support and resistance levels mentioned above, as they could provide important signals for the direction of GBP/USD. Additionally, traders may want to monitor the latest news on the UK economy, as any significant developments could impact the currency pair.