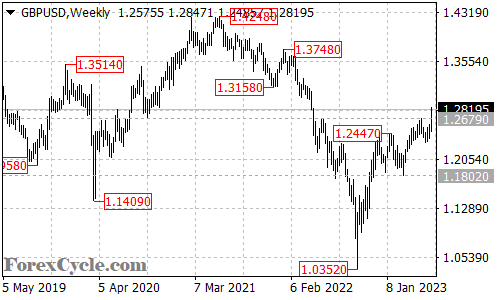

The GBPUSD currency pair has made a significant breakthrough, surpassing the key resistance level at 1.2679 and extending its long-term upside move from 1.0352 to reach as high as 1.2847. This breakout suggests that bullish momentum is strengthening and sets the stage for potential further gains in the coming weeks.

With the breakout above 1.2679, the GBPUSD pair has signaled a continuation of its upward trajectory. Traders and investors can anticipate additional upward movement as the pair targets the next significant level of resistance at 1.3200. This area could provide a challenging hurdle for the pair, but if the bullish momentum persists, it has the potential to be overcome.

In terms of support levels, the near-term support is identified around 1.2300. Should the price experience a temporary pullback or consolidation, this level could provide a floor and a potential buying opportunity for market participants. However, a breakdown below this support level may signal a retracement towards the 1.1802 support area, where buyers could potentially reenter the market.

In conclusion, the GBPUSD currency pair has broken above the key resistance level at 1.2679, indicating a continuation of its long-term upside move. Further upward momentum is expected, with the next target at the 1.3200 area. Traders should watch for potential support at 1.2300, and a breakdown below this level may lead to a retracement towards the 1.1802 support level.