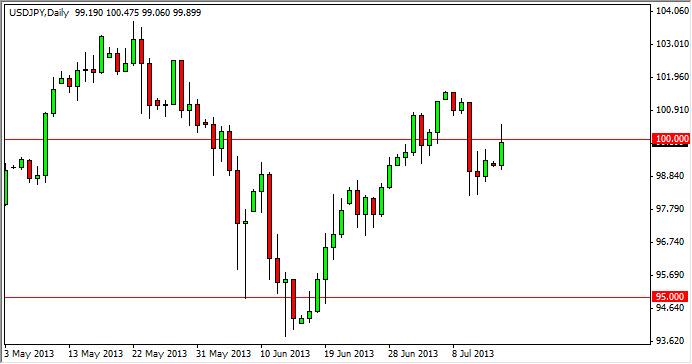

The USD/JPY pair rose during the session on Monday, but as you can see the 100 level has offered far too much resistance for the market to overcome. However, we are not about to start selling this market, regardless of the shape of the candle. After all, the Bank of Japan continues to work against the value of this currency pair, and we believe that isn’t going to change anytime soon.

The US Dollar of course has been beat up fairly significantly lately, so it’s not a surprise that we failed to get over the 100 handle. However, we believe that it’s only a matter of time before this market gets higher, and as a result we like the idea of buying a break of the highs for the Monday session. Alternately, we can also make a case for buying this market on a pullback that shows a supportive candle, which is almost always one of the preferred method of entry in an uptrend.

As far as selling is concerned, we simply won’t do that in this pair, because buying the Japanese Yen is dangerous to say the least. After all, it is one of the most manipulated currencies in the world, and that is especially true these days. Going forward, we think that this market will eventually hit the 105 handle sometime this year, and possibly even as high as 110 if certain things happen. However, recently we have seen the market try to react to the possibility that the Federal Reserve is going to continue to keep the quantitative easing at full blast, as opposed to tapering off in September as so many people at thought.

Another thing you have to worry about though is the fact that this is the summer, and therefore the liquidity is probably a bit then. With that being the case, this market is probably getting thrown around at the moment, and as a result is very difficult to read too much into the price action from day-to-day. Nonetheless, we do recognize the fact that the market has a bit of a “floor” in it at the moment.

Written by FX Empire