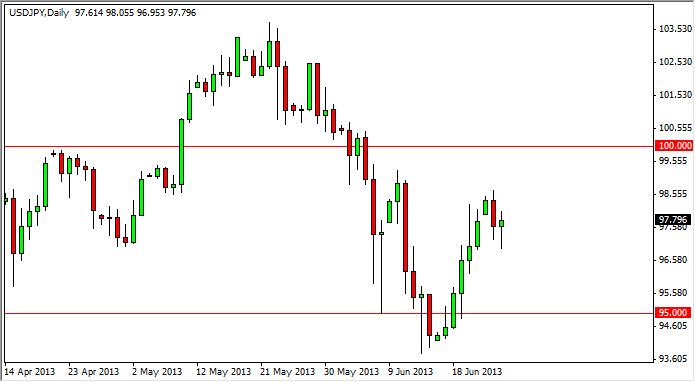

The USD/JPY pair fell during most of the session on Tuesday, but as you can see got a bit later in the day in order to form a hammer. This hammer suggests to us that the market is going to try and rally from this point, even though it hasn’t had much of a pullback. On top of that, expect the Bank of Japan to get involved sooner or later. Not directly, but they will continue to talk down the value the Yen, and with the rising interest rates in the United States this sets up a “perfect storm” if you will.

This pair traditionally will follow the differential between 10 year notes in America, and 10 year notes in Japan. Because of this, it makes a lot of sense that pay attention to the yields in both bond markets in order to get an idea as to what the bias of the pair might be. However, we believe that a lot of this will be predicated upon the idea that the Federal Reserve is going to step away from asset purchases over the next several months, and because of that we do expect this market to continue going higher. After all, the Bank of Japan has just started its quantitative easing, and still has quite a ways to go.

With that being said, we are buyers on the dips in this market that show signs of support. The hammer that formed for the Tuesday session is certainly a good example that. With that being said, we believe that this market should start to get more interest as the buyers stepped in. On the other hand, we could possibly break down a bit from here, but have a very difficult time imagining this pair staying below the 95 handle for any great length of time. Because of this we have a bit of a “backstop”, and will take advantage of that. After all, the Bank of Japan will more than likely be very alarmed on a move below the 95 handle, and as a result there is only one way you can trade this pair: up.

Written by FX Empire