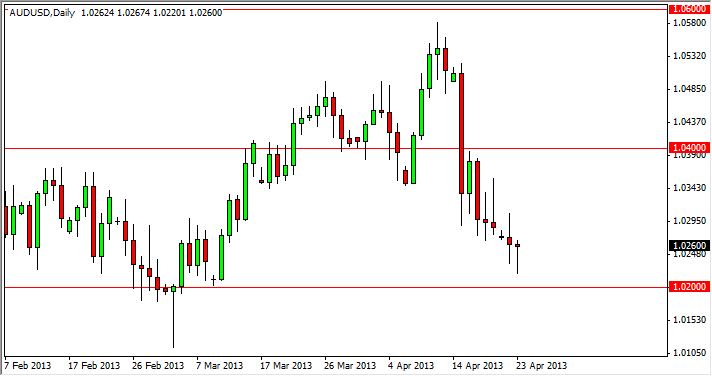

The AUD/USD pair fell during most of the session on Tuesday, but found support just above the 1.02 handle as expected. The reason for this is that the 1.02 handle has certainly been supportive over the last year and a half as the market has bounced around between that level and the 1.06 level on the upside. With that being the case, we had mentioned recently that we would love to see this pair pullback fairly close to that level, and it actually has. This is in our opinion, a buying opportunity.

With that in mind, we are very interested in buying this market on a break of the highs from the Tuesday session. After all, it formed a hammer right where we would like to see it. Looking at this chart, it’s very easy to imagine this market heading back to the 1.04 level without too many issues, and quite possibly even going as high as 1.06 later as it tries to return to the top of the recent range.

Looking forward, we think that the gold markets could give a little bit of a boost to the Australian dollar as well, as we are starting to see support come back into that market also. Nonetheless, the Aussie dollar certainly seems a bit oversold at this point in time, and as the markets continue to show interest in risk appetite assets, the Australian dollar should do quite well in that particular scenario.

There could also be a little bit of a bid based upon the fact that the interest rate differential is relatively strong. In a world that has very little to offer in the way of yields, this important aspect cannot be overlooked. In fact, it is more the norm than anything else, even though we have seen very erratic moves in the Forex markets recently. We do however; I expect to see this pair grind higher as the Australian dollar certainly has been oversold recently. As for selling, we would have to break down below the 1.01 handle, something that would take serious bearish strength to do so.

Written by FX Empire