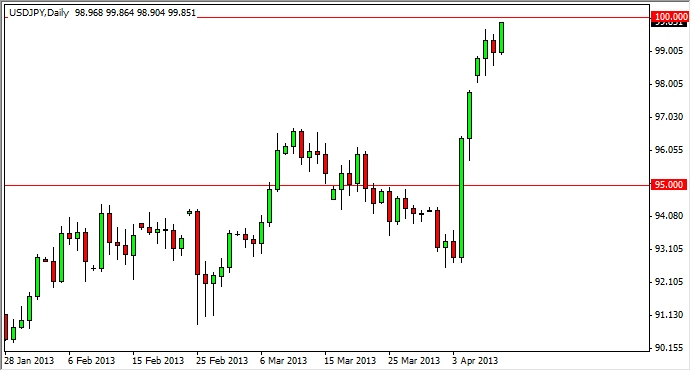

The USD/JPY pair rose during the session on Wednesday, testing the 100 handle yet again. As we close towards the top of the day’s range, we cannot help but think that the 100 level gets broken sometime in the next few hours. However, we think that this level will be a bit of a test for the pair, more or less for a psychological significance than anything else.

We believe that the Bank of Japan will continue to scare people out of the Yen, and as a result this market could race much farther than anyone anticipates. We believe that this is a long-term trade, and as a result we fully intend on holding onto any long positions for as long as humanly possible, and will look at the dips in this market as buying opportunities. The real question is whether or not the 100 level will hold the market back. Certainly, you can say that this market is a bit overbought at this point time, but that does not mean we would be willing to sell it, as we see the market been far too strong to the upside in order to be bothered.

Any pullback at this point time would have to be treated with suspicion, and we would without a doubt be willing to buy supportive action even on the lower time frames. This will be especially true when talking about “handles”, or what is also known as round numbers. We recognize that they should continue to play a significant part in this marketplace, and although we haven’t seen any pullback yet that was of any decent significance, we believe that traders will be using these large numbers to simply place trades to try and reenter any positions that they have close, or simply try to join the party that they have missed. Going forward, we think that this pair will be the most “insulated”, as the US dollar continues to be desired by a lot of traders out there. So days there is a “risk off” feel to the markets, this pair will fall less than the others.

Written by FX Empire