The USD/JPY pair is without a doubt one of the most interesting pairs at the moment. In this market you have a matchup of two central banks that seem dead set on killing off their currencies. After all, the Bank of Japan is in hyper easing mode, and the Federal Reserve seems to think that managing an “orderly decline” in the value of the Dollar is one of their mandates.

The Friday session will see an important inflection point in this pair as the Bank of Japan is expected to announce some kind of easing. The higher Yen value is absolutely decimating the exporter’s profits, which is by far the most important part of the Japanese economy, and as such the Bank of Japan is desperate to devalue their currency if at all possible.

The meeting is expected to produce some kind of expansion to the bond buyback program that the central cranked up recently. Simply put, this allows the central bank to buy Japanese Government Bonds to replace the lackluster demand by the Japanese public. The public has long been buyers of the bonds as they prepared for retirement. However, much like the United States, the Japanese had a massive baby boom after World War II, and as a result the largest group of people in the country is now facing retirement. They won’t be buying these bonds. The Bank of Japan is buying the bonds because they have to. Also, this has the added benefit of essentially creating Yen out of thin air, so of course it will have an effect on the value of them as the supply and demand curve gets out of whack. Estimates are for the central bank to announce an expansion of 5 Trillion Yen in this program. Needless to say, anything larger than that would be detrimental to the value of the Yen.

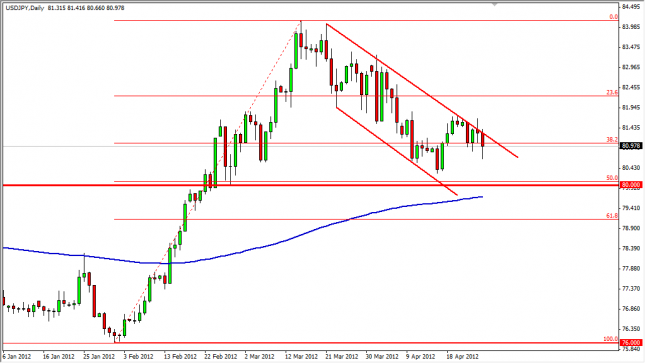

The recent action has been centered on a downward channel in this pair, and the bears have been pushing prices down through it. The move has brought out calls for a falling market, and the bears are starting to make a lot of noise in the press. However, the 80 level is just below, and this is a massively strong support level that has history to back it up.

With this in mind, we like the idea of buying, but we need to see a couple of things come into play first. For example, a break above the top of the downtrend channel would be a massive buy signal for us as we think the uptrend will continue if this happens. Of course, there are other things that could help as well, such as the 50% Fibonacci level just above the 80 level, and the 200 day exponential moving average just below it. All of these areas could provide the support we are looking for. We are buying on supportive candles at any one of these junctions or the aforementioned breakout as all would show the continuation of the massive breakout that has occurred. We don’t see a selling opportunity at the moment.

Written by FX Empire