Johnson & Johnson (JNJ) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average, and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue. Johnson & Johnson is one of the world’s most valuable companies and is one of only two U.S.-based companies that has a prime credit rating of AAA, higher than that of the United States government.

JNJ January 2022 Daily Chart

From March 2020 low, JNJ did a leading diagonal Elliott Wave structure. It achieved our minimum target at 178.97 from 156.93 gave us a 14.04% return. The rejection was strong enough to give us the conviction that wave II is in progress and wave I finished at 179.92.

The drop began and we considered an ((A)), ((B)), ((C)) zigzag correction to complete wave II. $JNJ ended the impulse as wave ((A)). Then we saw a bounce that we are calling as irregular flat as wave ((B)) and we were expecting one more low to 150.71 to complete wave ((C)) and wave II to continue with the rally. (If you want to learn more about Elliott Wave Theory, please follow these links: Elliott Wave Education and Elliott Wave Theory).

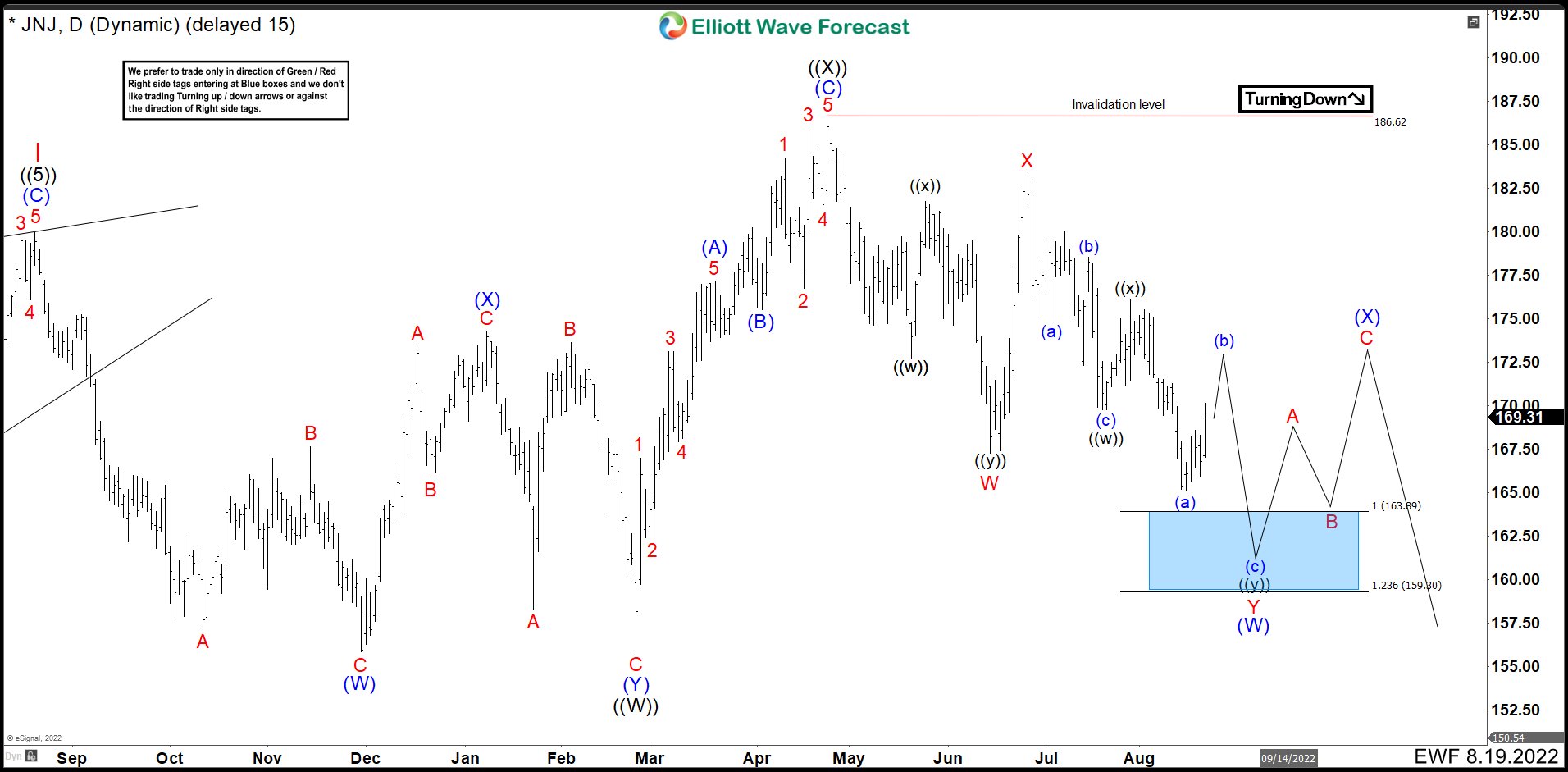

JNJ August 2022 Daily Chart

The correction ended, but just below the last low at 155.71 and rallied as expected breaking to new highs. However, the market conditions give us the idea that JNJ wave II is not done. It is better to think that we are going to break 4/24/2022 low to complete wave II. Therefore, it is better to adjust the labeling as a double correction. The first wave ((W)) did a double correction from 179.92 to end at 155.71. Then rally to 186.62, we labeled as a zig zag correction as wave ((X)). Currently we are developing wave ((Y)) and the structure shows that the best count is as a double correction.

Down from 4/25/2022 high, we could see 7 swings lower completing wave W at 167.26. A strong bounce ended wave X at 183.41. Another 7 swings correction looks like is developing to complete wave Y and wave (W). The drop from 186.62 built 3 swings ended at 169.74 as wave ((w)). A corrective bounce finished wave ((x)) at 176.07 and we need 3 more swings lower to complete the Elliott Wave double correction structure. Consequently, we are expecting 3 swings lower to complete wave ((y)) of Y of (W) and see a reaction higher. The best area to that happens come in 163.89 – 159.30. We recommend to look for buying opportunities in this area to see at least 3 swings higher before turning lower again or with the possibility that rally in JNJ continues.

Source: https://elliottwave-forecast.com/stock-market/johnson-jnj-continue-choppy-downside/