UK Brent Oil has been on a bullish trend since the lows of April 2020 – the start of the Covid19 pandemic. Despite the fears of UK Oil dropping in value we witnessed price climbed from 20.00 to 130.00 within the space of two years.

Ever since the highs we have been within a corrective nature in a bearish counter-trend. Nevertheless, we remain bullish on UK Oil from at least 10000 ft high.

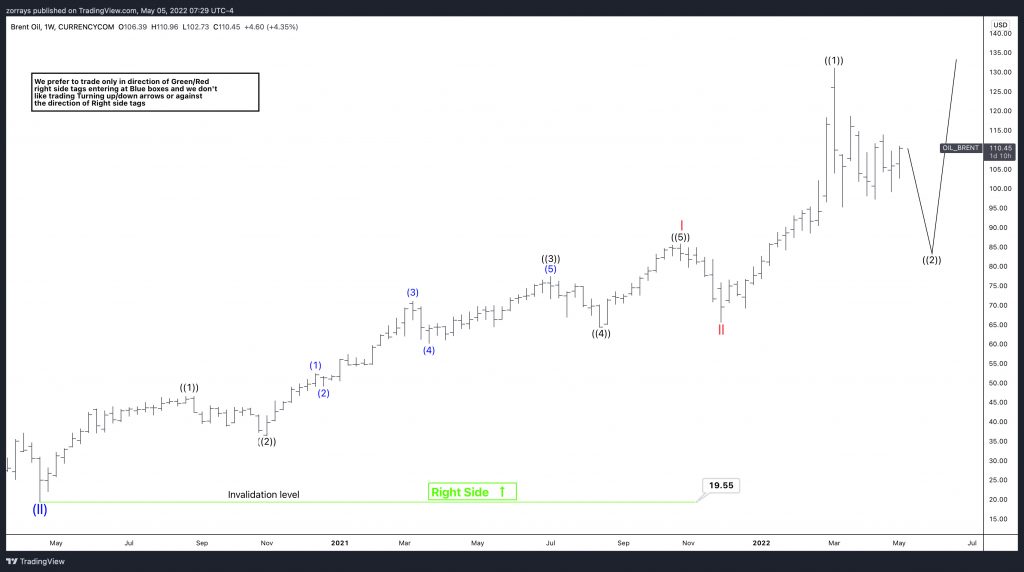

UK Oil – Weekly time frame 5th May 2022

We are essentially calling for another push within that corrective cycle of wave ((2)). This would be before seeing a continuation to the upside into wave ((3)) of (II). Wave 2 corrective cycles are more price based corrections. We ideally want to see some form of a deep correction such as Zigzag or a variant of a Zigzag such as a WXY double correction.

Lets have a deeper look at how wave ((2)) is unfolding.

UK Oil – Daily time frame 5th May 2022

So, this is developing as a double correction which therefore means we have two corrections i.e. ZigZag joined with an (X) connector in the middle. We are calling for another low into 80.00 potentially subject to remaining above 65.74 prior to seeing the next advance into wave ((3)).

As time is going on, we can see that the market sentiment according to our count is that overall there are more appreciation left as opposed to expecting a long term depreciation within the price. UK Oil prices are expected to increase based on the war we have been witnessing between Russia and Ukraine as the United Kingdom decided to slap sanctions on Russia. We can expect further set of sanctions also pushed from the EU by the end of 2022.

Source: https://elliottwave-forecast.com/uncategorized/uk-oil-brent-one-push-prior-advance/