With Gold breaking to new all-time high against Yen and Euro dollars, it’s just a matter of time before Gold and Silver breaks to new all-time high against US Dollar. Silver Miners (SIL) ETF leverages the move in the underlying metal. Once Silver starts moving higher with the rest of commodities, the ETF should outperform. Technically, SIL has reached 7 swing extreme area from August 6 peak and it’s the perfect time to start reacting higher. Let’s take a look at the Elliott Wave update below:

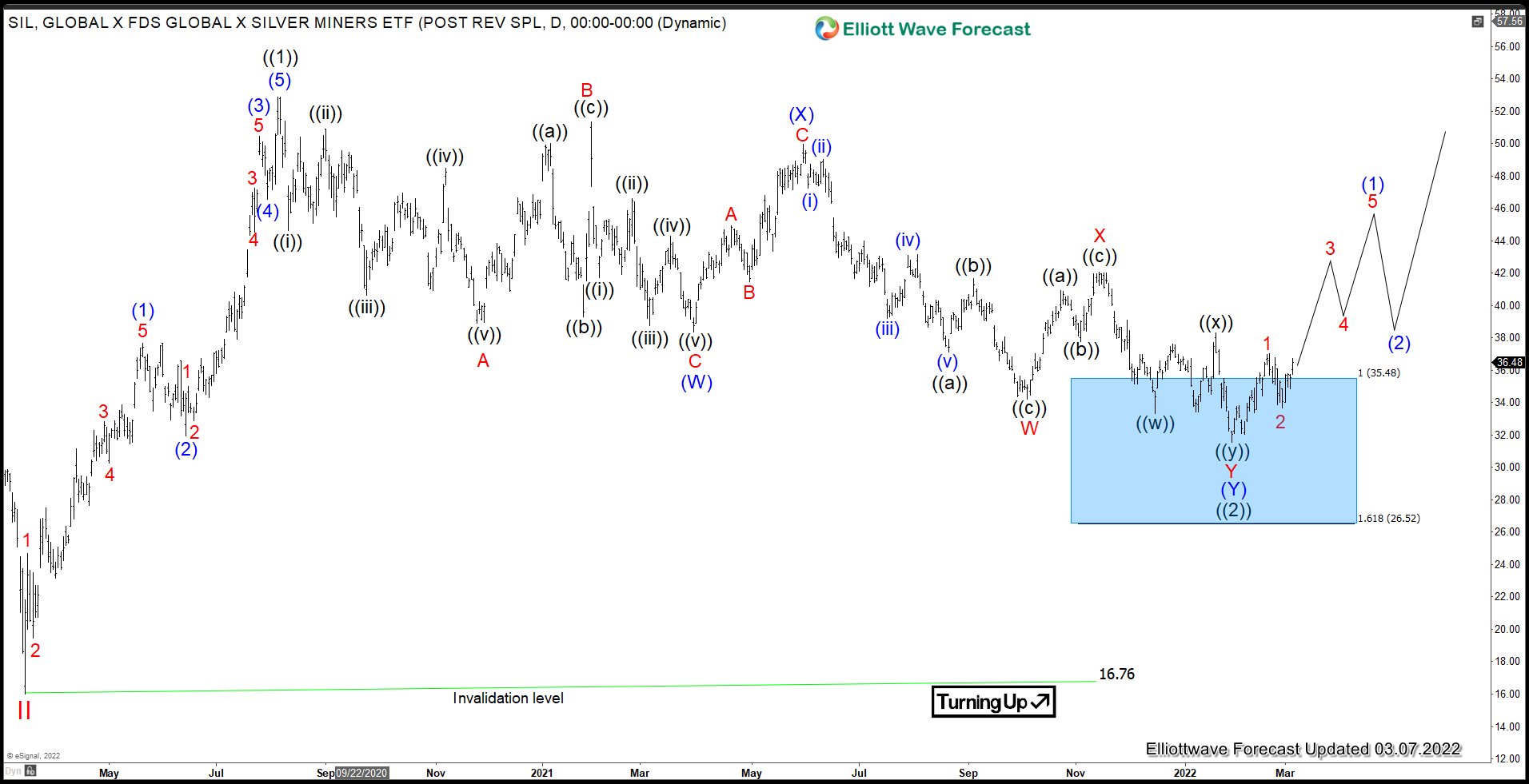

SIL Monthly Elliott Wave Chart

The Monthly Chart above shows that there’s a good chance the ETF has ended ((2)) pullback at $31.54 at the blue box. This blue box is the 100% – 161.8% Fibonacci extension from August 7 peak. It’s still at the early stage before the next big move higher. Expect the ETF to outperform in the many months to come.

SIL Daily Elliott Wave Chart

The ETF formed wave ((2)) base on January 28, 2022 at $31.54. From there, it rallied in 5 waves and ended wave 1 at $37. Pullback in wave 2 has also ended at $33.69 and the ETF has started to extend higher again. While above $31.54, and more importantly above March 2020 low at $16.76, expect the ETF to continue higher.

Source: https://elliottwave-forecast.com/stock-market/silver-miners-earlystage-bullrun/