Cryptocurrencies have become very popular worldwide. Many young investors want to chase every move the instrument does daily. The reality is that many traders tend to trade without looking at the higher time frames. Traders also don’t relate instruments that trade within the same group. $BTC (Bitcoin) might have ended the all-time cycle when it peaked at 11.01.2021.

Currently, $BTCUSD is trading at $38275. However, there is a possibility that it can trade much lower into the $23267-$17903 area or even lower. The price to buy the leading cryptocurrency is still high, so we are looking at BITO as a much better instrument and cheaper to invest in crypto. BITO (Proshares Bitcoin Strategy ETF ) was the first U.S. bitcoin-linked ETF offering investors an opportunity to gain exposure to bitcoin returns in a convenient, liquid, and transparent way.

The Fund seeks to provide capital appreciation primarily through managed exposure to bitcoin futures contracts. By definition, an ETF is a collection of hundreds or thousands of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges, like the New York Stock Exchange and NASDAQ. Many investors buy Cryptocurrencies without understanding the risk that comes with it. BITO provides investors with a cheaper alternative than investing directly. In addition, it is arguably a safer alternative for gaining exposure as it does not involve using a wallet required for Bitcoin.

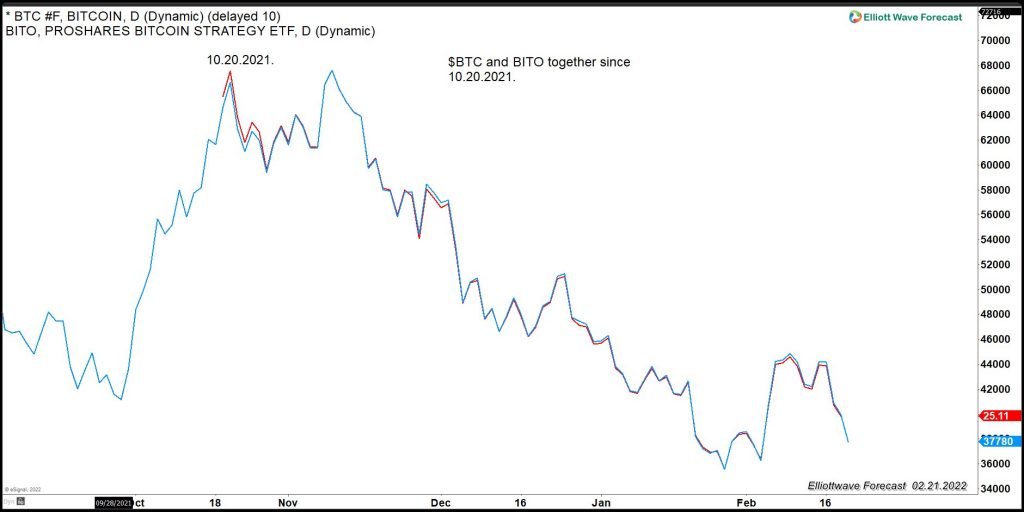

Investors should be aware that the BITO ETF does not hold Bitcoin directly, but the price action is almost identical. As we mentioned above, many new traders do not understand or use multi-market correlation and mostly rely on the short-term charts of a single instrument. We will present three steps of Market correlation, providing the right timing to invest in BITO. First, the relationship between $BTC and BITO as the following chart shows

Correlation between Bitcoin and BITO

The chart above shows the price action since BITO entered the marketplace back on October 18th, 2021. The price action is almost identical, proving that trading BITO is the same as trading $BTC. Secondly, we need to understand that Bitcoin is trading against the USD, which makes the USD path key to determine the path of Bitcoin. The following chart is a correlation chart between Bitcoin and US Dollar Index:

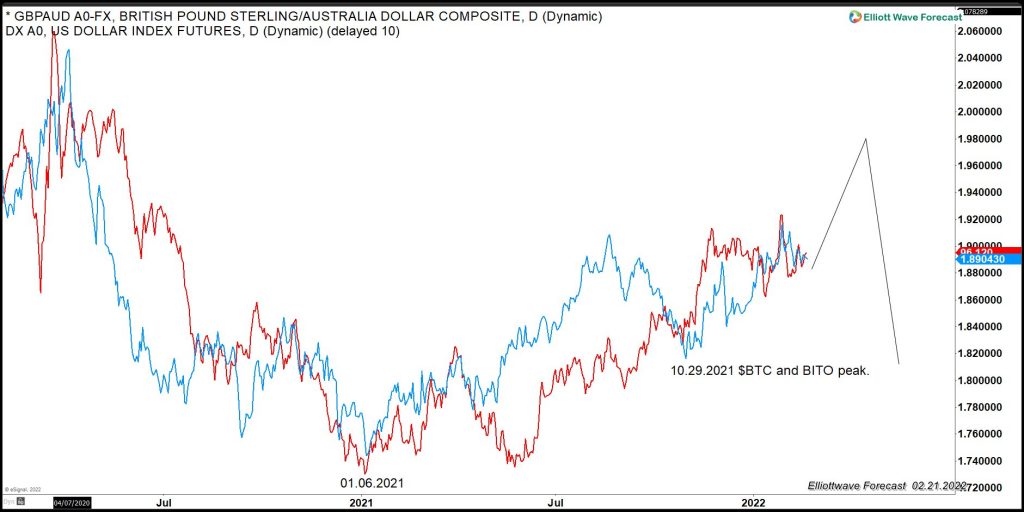

Correlation chart between Bitcoin and USD Index

The chart above shows $BTCUSD and $USDX moves together in the opposite direction. This means a higher $USDX makes $BTC going lower. Thirdly, to understand what the Dollar Index should be doing, we will use $GBPAUD as a pair showing an incomplete sequence in favor of the $USDX as the chart below shows:

Bullish Sequence in GBPAUD Favors More Upside in USDX

The chart above shows the relationship between the two instruments. It shows the USD should trade higher until $GBPAUD reaches the extreme Blue Box area from the low at 01.06.2021. We can also see the 10.29.2021 low, which is the same as the peak at BITO and $BTC. In conclusion, we know $GBPAUD should trade higher and take the USD with it higher. We also see that a higher USD will make $BTCUSD to trade lower into the $23267-$17903 or even lower. Consequently, BITO will trade lower following $BTCUSD. A multi-market analysis allows us to get a better price and timing to invest in BITO and therefore buy $BTCUSD at a lower and safer cost.