Nikkei Futures (NKD) shows a lower low bearish sequence from February 16, 2021 peak. The Index also shows a 5 swing bearish sequence from June 15, 2021 peak. Both of these sequence suggest Nikkei likely see further downside. Below is the chart showing a 5 swing sequence from June 15, 2021 peak.

Nikkei (NKD) 5 Swing Sequence from June peak

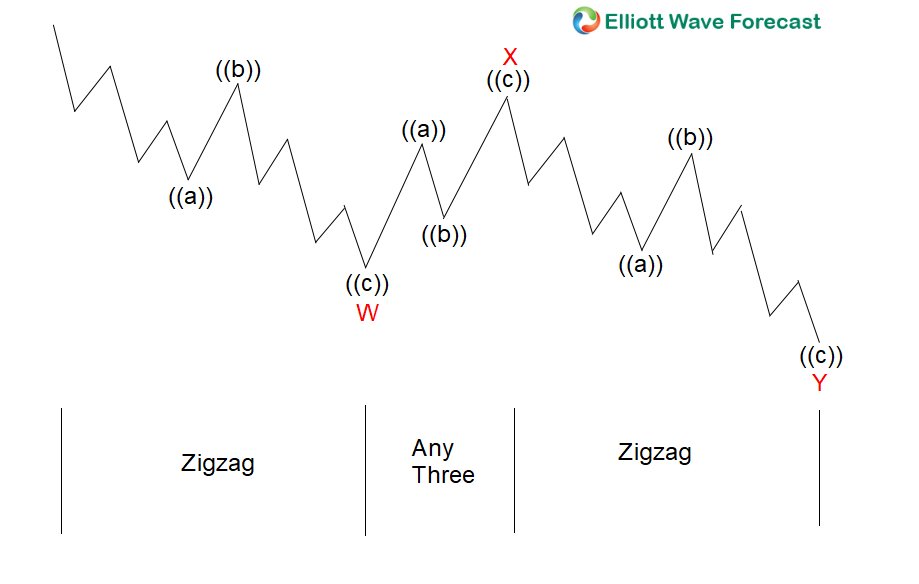

The chart above shows a 5 swing sequence from June 15, 2021 peak. Please note this is not an Elliott Wave label, rather it’s just a swing count. A 5 swing is an incomplete sequence as corrective sequence always ends in 3, 7, or 11 swing. We can label this move in 2 ways, but both with the same conclusion that it is likely to see further downside. The first way to label is to treat the 5 swing as part of a 7 swing WXY double three structure. Below is the WXY 7 swing general structure

Double Three (7 swing WXY) Elliott Wave Structure

If the 5 swing move lower is labelled as double three WXY, then Nikkei should continue lower in 7th swing to end the WXY pattern. The 100% – 123.6% Fibonacci extension target in 7 swing comes at 26309 – 26797.

A second way to look at the move lower from June 15 peak is to label it as a 5 waves diagonal which ends wave A at the low as the chart below shows:

In the chart above, the Index can see a 3 waves rally to correct the decline from June 15, 2021 peak before it turns lower. Either way, more downside is expected in the Index.