USDCAD Technical Analysis

On April 27/2020 I posted on social media (Stocktwits/Twitter) @AidanFX “USDCAD Still possible the pair can extend lower below 1.4000. Possible momentum breakout lower at 1.4038”

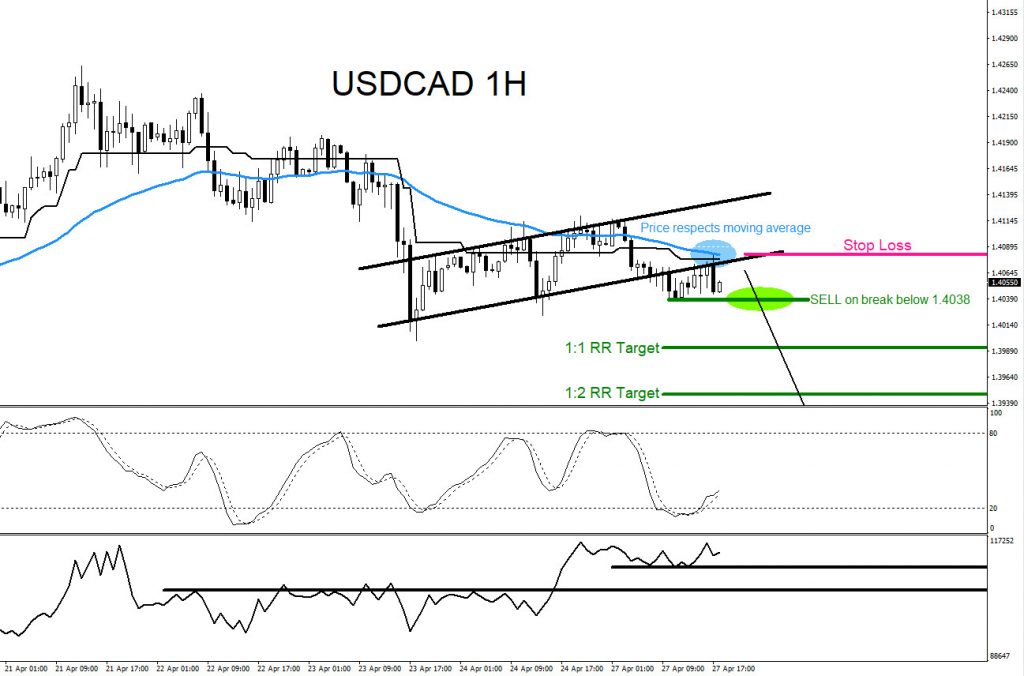

USDCAD 1 Hour Chart April 27.2020 : The chart below was also posted on social media (StockTwits/Twitter) @AidanFX April 27/2020 showing that a bearish flag breakout pattern (black) has formed and needed a break below 1.4038 to confirm momentum of the breakout. I called for traders to watch for SELLS on the break below 1.4038 as long as price respects the moving average (light blue).

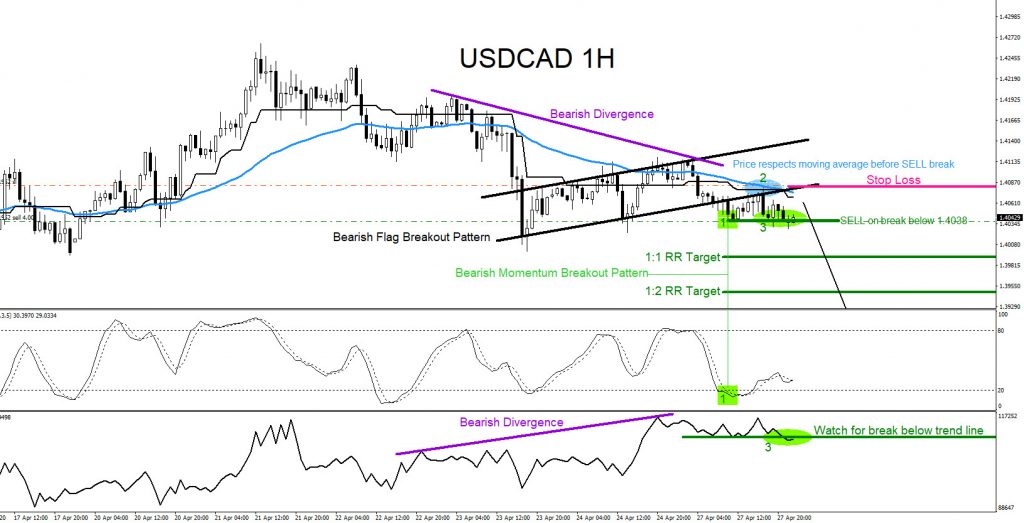

USDCAD 1 Hour Chart April 27.2020 : Price respects the moving average (light blue) and breaks below 1.4038 triggering the SELL trade. A bearish Momentum Breakout Pattern (light green) was visible on the top indicator and on the price chart signalling that a break below 1.4038 will push the pair lower. Bearish divergence (purple) was visible and the bottom indicator also confirmed the SELL trade when it broke below the green trend line.

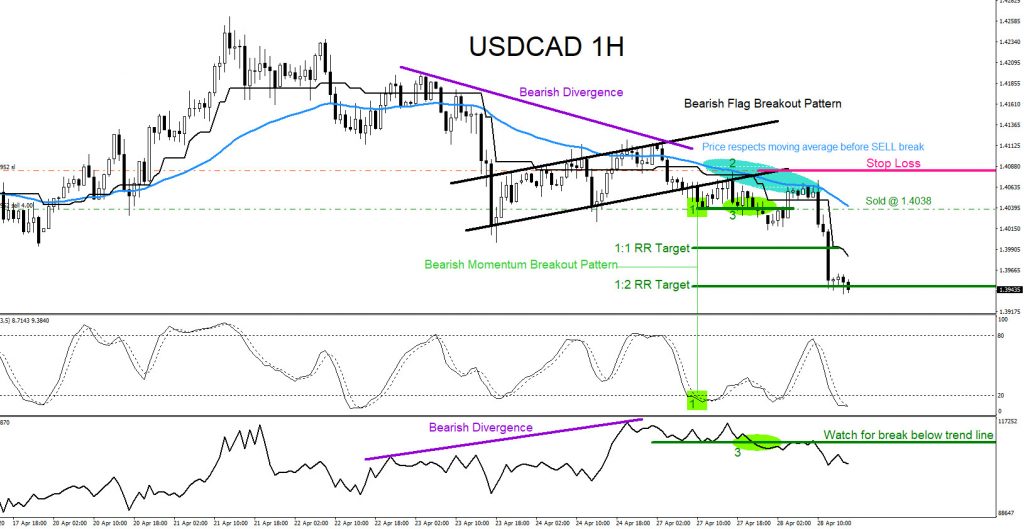

USDCAD 1 Hour Chart April 28.2020 : The pair moves lower continuing to respect the moving average (light blue) and hits the 1:2 RR target (green) for +90 pips. The move lower did not show any indication of a possible move higher so I continued to hold the SELL trade looking to see a downside continuation. As long as price did not hit the stop loss the pair remained bearish.

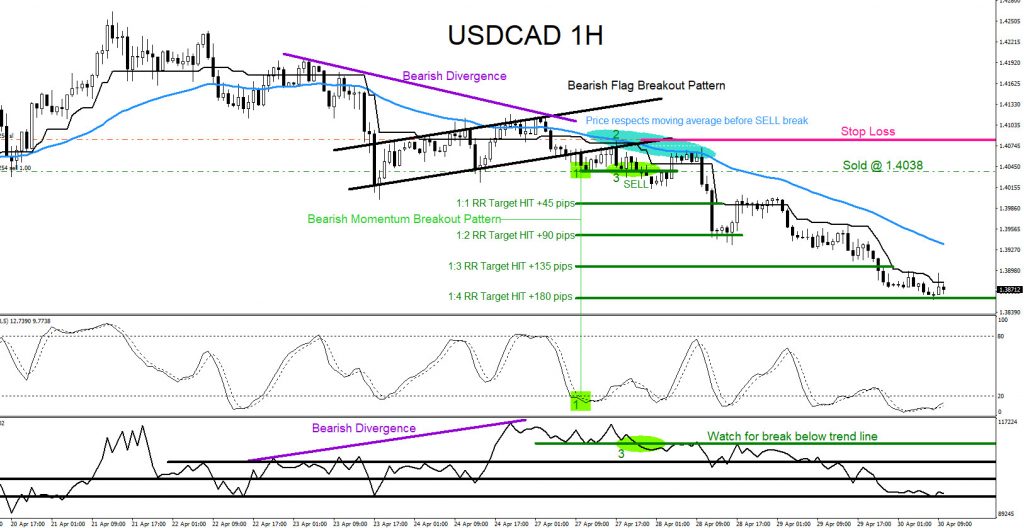

USDCAD 1 Hour Chart April 30.2020 : Price remained trading below the moving average (light blue) confirming the downside trend was still active. The pair eventually hit the 1:4 RR target (green) for +180 pips. If you followed me on Twitter/Stocktwits you too could have caught the USDCAD breakout move lower.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on Twitter for updates and questions> @AidanFX or chat me on Skype > EWF Aidan Chan

*** Always use proper risk/money management according to your account size ***

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Stocks and ETFs) in 4 different timeframes and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Chat Room. Our clients are always in the loop for the next market move.