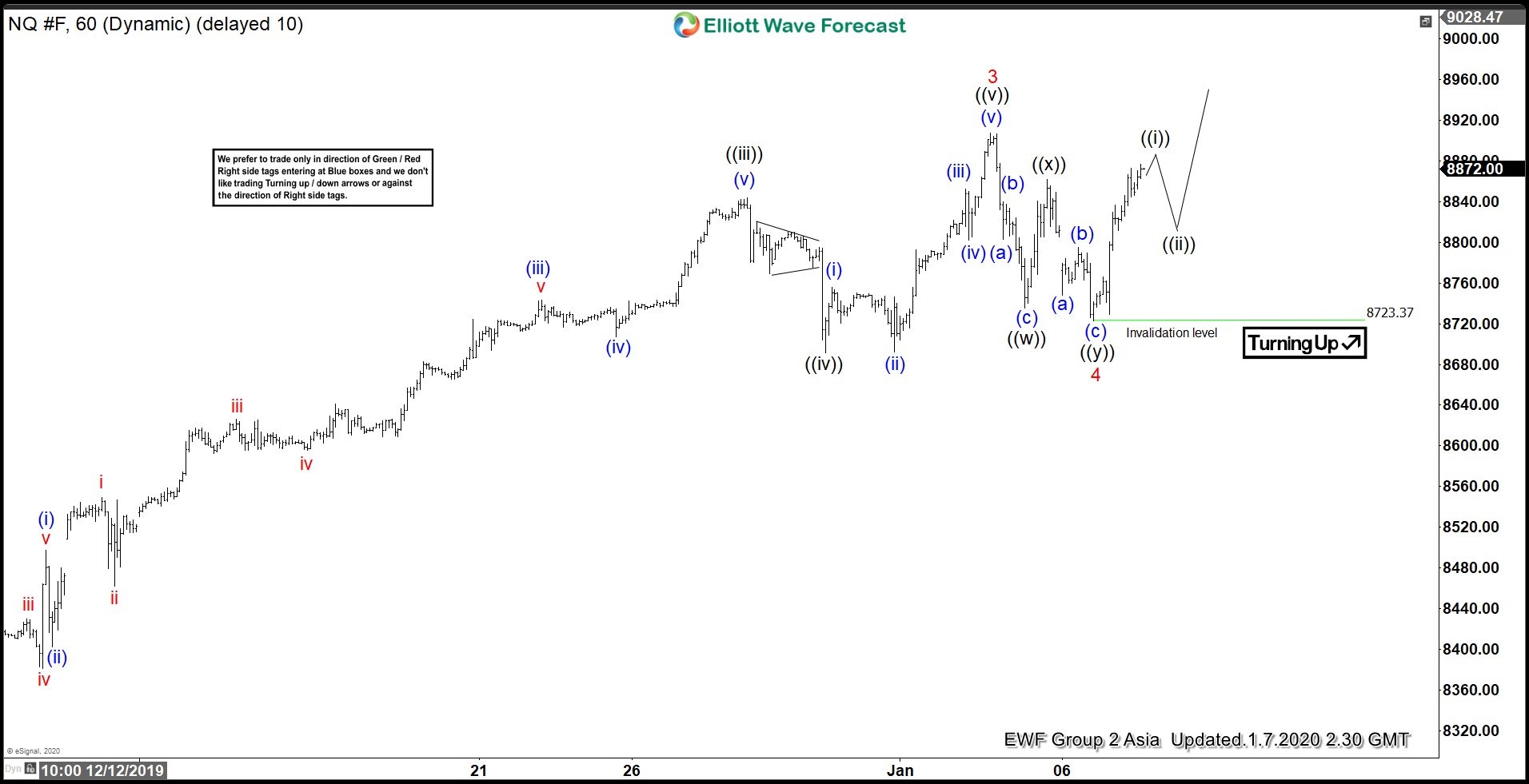

NQ_F (Nasdaq Futures) made a sharp decline yesterday evening after New York closing and then reacted higher in a very strong manner. Our preferred Elliott wave count treats the dip last night as a Minor wave 4 and now we are expecting the Index futures to be trading higher in Minor wave 5. Earlier this week, we saw 3 waves down from the peak at 1.2.2020 (8907.25) so we called wave 4 completed and started calling higher in wave 5. Let’s take a look at the chart below.

NQ_F 1 Hour Elliott Wave Update 1.7.2020

Chart below shows the idea of wave 4 completed at 8723.37 and as dips held above this level, expectations were for Minor wave 5 to continue higher. Corrections unfold in the sequence of 3, 7 or 11 swings and after 3 swings, a correction could always become 7 swings as far as the previous high or low doesn’t give up. In this case, we were aware that 5 waves rally from 8723.37 could be part of a FLAT correction also from 1.3.2020 (8735.25) low high of wave 3 was still intact so we made it clear to the members that another push lower in wave 4 could still take place and hence why we didn’t like the idea of buying wave ((ii)) pull back. In our Group 2 Live Analysis Session, we also highlighted the next area of interest to complete wave 4 pull back in case we got another push lower.

NQ_F 1 Hour Asia Update 1.8.2020

After the New York closing yesterday, NQ_F (Nasdaq Futures) made a sharp decline and reached 100 – 161.8% Fibonacci extension area (8710.20 – 8596.53) of the initial 3 waves down from 1.3.2020 (8907.25) to 1.6.2020 (8723). It quickly started bouncing again and we called wave 4 completed in the blue box. Below is the chart from Asian update presented to clients last night

Chart above shows the idea of wave 4 being over at 8678 and as dips held above this level, the expectations were for the rally to resume in wave 5. Index futures continued the rally today into London and New York sessions and let’s take a look at the latest 1 Hour updated chart to see where we are right now.

NQ_F 1 Hour Midday New York Update 1.8.2020

Index futures have already made a new high above wave 3 peak (8907.25) and appear to be already within wave ((iii)) of Minor wave 5. Minimum target for any longs from the blue box is the inverse 123.6 – 161.8% Fibonacci extension area of wave 4 pull back which lies between 8962.59 – 9050.77. If we are still in wave ((i)) of 5, then it can see more extension to the upside within Minor wave 5 and in case 9050.77 level is exceeded, then 9136.44 – 9244.87 would be next area of interest to look at for completion of Minor wave 5.