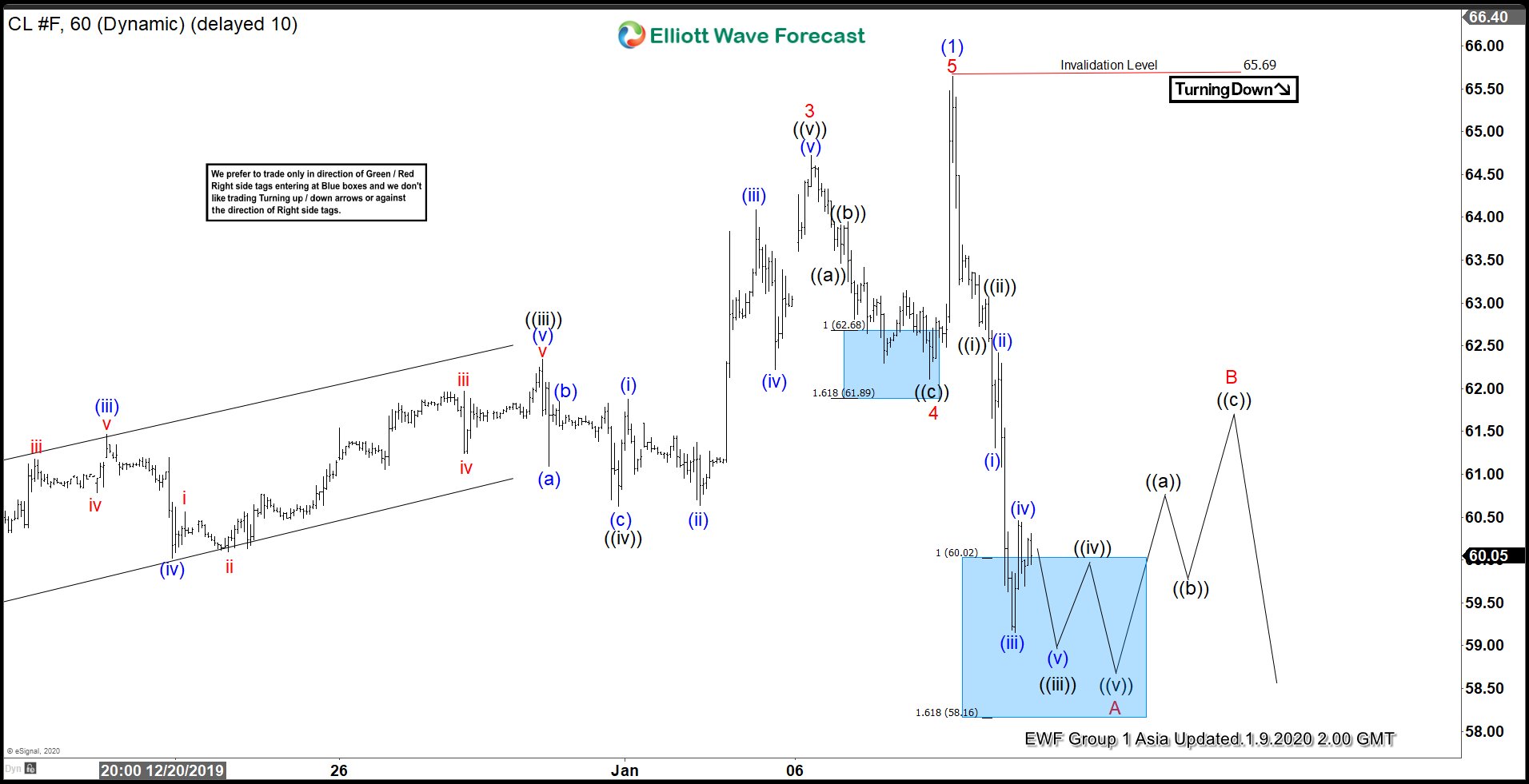

Elliott Wave view on Crude Oil ($CL_F) suggests rally to $65.69 on January 8, 2020 ended wave (1). This ended a 5 waves rally from October 3, 2019 low. Oil is now doing wave (2) pullback to correct the cycle from October 3, 2019 low before the rally resumes. The decline is unfolding as a zigzag Elliott Wave structure where the first leg of the zigzag wave A remains in progress. Down from $65.69, wave ((i)) ended at $62.73 and wave ((ii)) bounce ended at $63.07.

Oil has resumed lower within wave ((iii)) with subdivision as another 5 waves in lesser degree. Another leg lower can be seen before wave ((iii)) ends, then it should bounce in wave ((iv)) before the another leg in wave ((v)) lower to complete wave A. Oil should then bounce in wave B to correct cycle from January 8, 2020 high before turning lower again in wave C. As far as pivot at $65.69 high stays intact in the bounce, expect rally to fail in the sequence of 3, 7, or 11 swing for further downside.

$CL_F 1 Hour Elliott Wave Chart