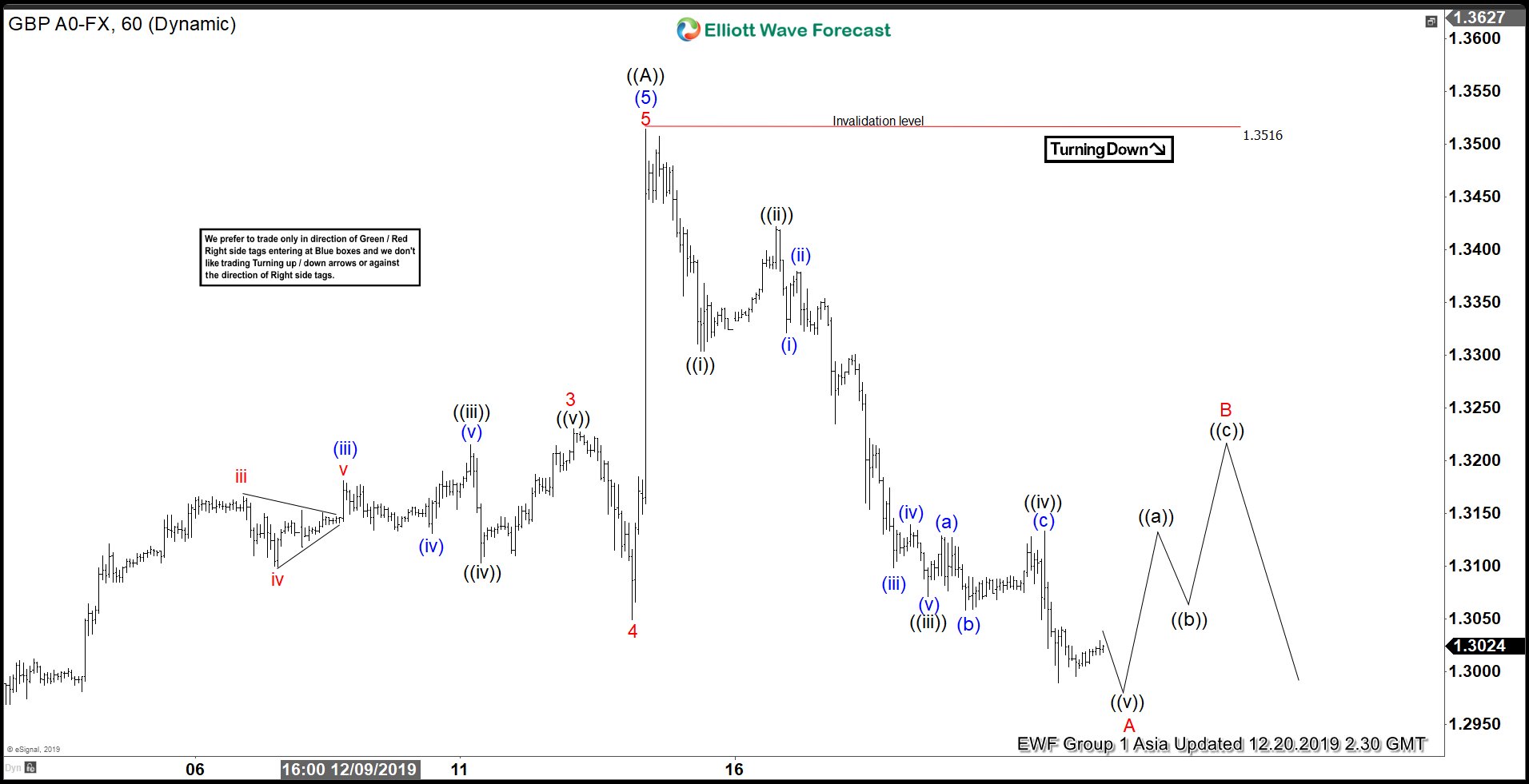

Short Term Elliott Wave view in GBPUSD suggests that the rally to 1.3516 ended wave ((A)). This rally ended cycle from 9.3.2019 low as a 5 waves impulsive Elliott Wave structure. Pair is now correcting cycle from 9.3.2019 low within wave ((B)) as a zigzag Elliott Wave structure. A zigzag is a 3 waves structure with ABC label and subdivision of 5-3-5. The first leg wave A subdivides as a 5 waves impulse. Down from 1.3516, wave ((i)) ended at 1.3304 and wave ((ii)) bounce ended at 1.342. Pair then extended lower in wave ((iii)) towards 1.307 and wave ((iv)) bounce ended at 1.313.

Wave ((v)) is expected to end soon and this should complete wave A of ((B)). Afterwards, pair should bounce in wave B to correct cycle from 12/13/2019 high in 3, 7, or 11 swing before the decline resumes. We don’t like buying the proposed bounce and expect sellers to appear in the sequence of 3, 7, or 11 swing as far as pivot at 1.3516 stays intact. Potential target for wave ((B)) is 50 – 61.8% Fibonacci retracement of the rally from 9.3.2019 low which comes at 1.232 – 1.273.

GBPUSD 1 Hour Elliott Wave Chart