Technical based traders using EWF’s Blue Box System on 12/19/2018 executed a near perfect entry short in the Consumer Discretionary ETF – XLY before the FOMC rate decision. Prior to the actual trigger of the trade, Elliottwave-Forecast.com analysis showed our Group 3 Membership the ideal entry range. It is in these ranges of symmetrical extremes where highly probable directional reactions most often take place. And, like the reaction we see in XLY, continue to confirm our method of sequence analysis.

This system we use is incumbent upon trading in what we dub “The Right Side”. Using our proprietary sequence and cycle analytical system we determine first if there is a bearish or bullish sequence present. Once a sequence has been established we determine if the cycle is incomplete. If incomplete then we have a trading opportunity at the next corrective swing against the direction of the cycle. A trading entry is then mapped and planned at the extreme area. The formulated invalidation level must remain intact to keep our traders on the correct side of the market.

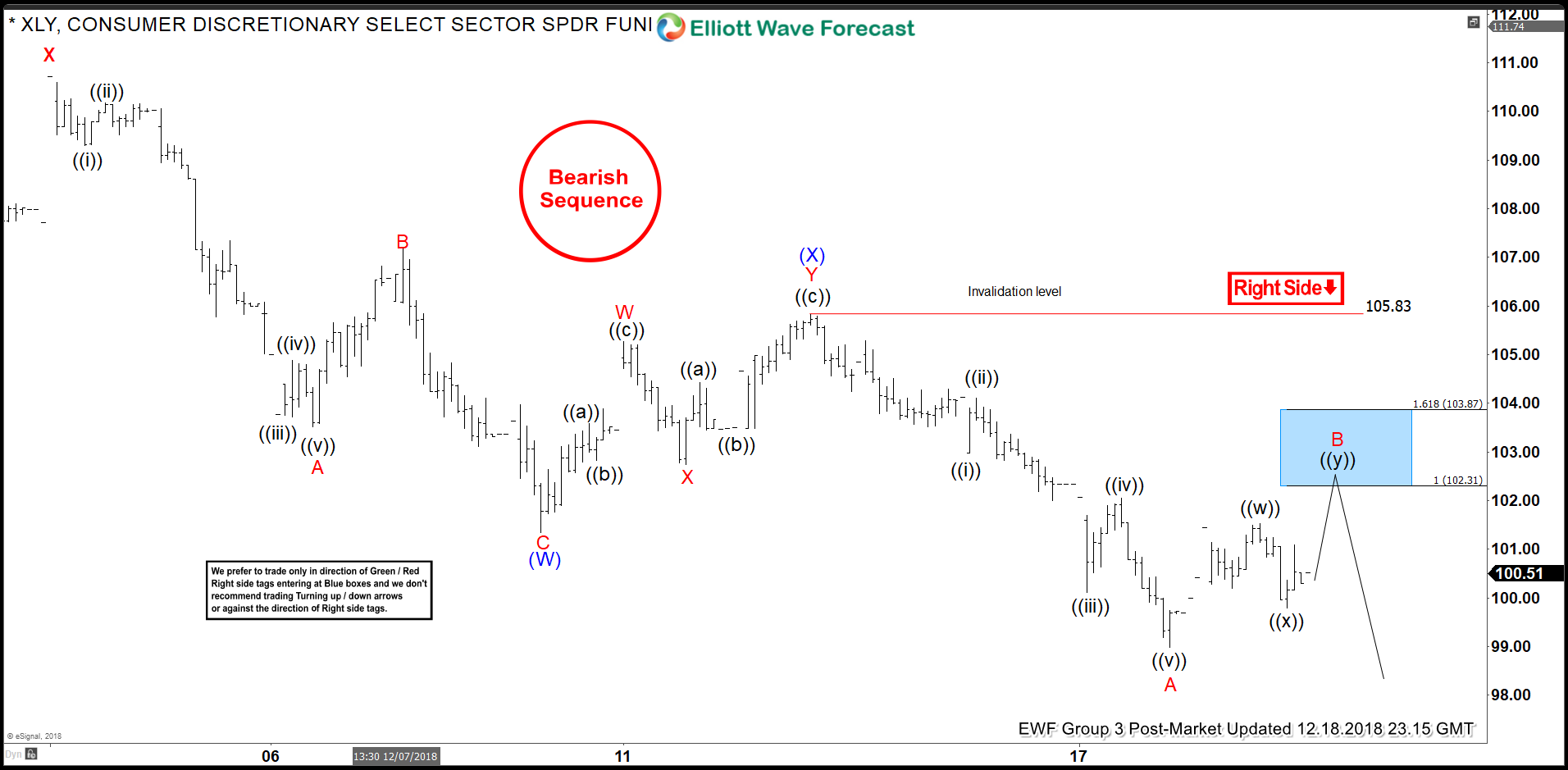

The 12/18/2018 Post Market Chart Setup for XLY

Over the years we’ve learned to trust what the charts are telling us versus chasing a fundamental event. The chart above highlights our intended selling range in blue. This area is where we would sell any 3, 7, or 11 “swings” back higher while prices remain below 105.83. Going in the trading session we already had a plan regardless of how the market interpreted the language of the FOMC.

On December 18th we issued recommendations to sell short XLY at 102.25 just before the 102.30 – 103.87 range to ensure all Members could participate regardless of their respective broker’s spread. Pre-Market, December 19th, in our Daily Group 3 Live Analytical and Trading Session we suggested XLY should melt up into the FOMC rate decision and trigger our shorts.

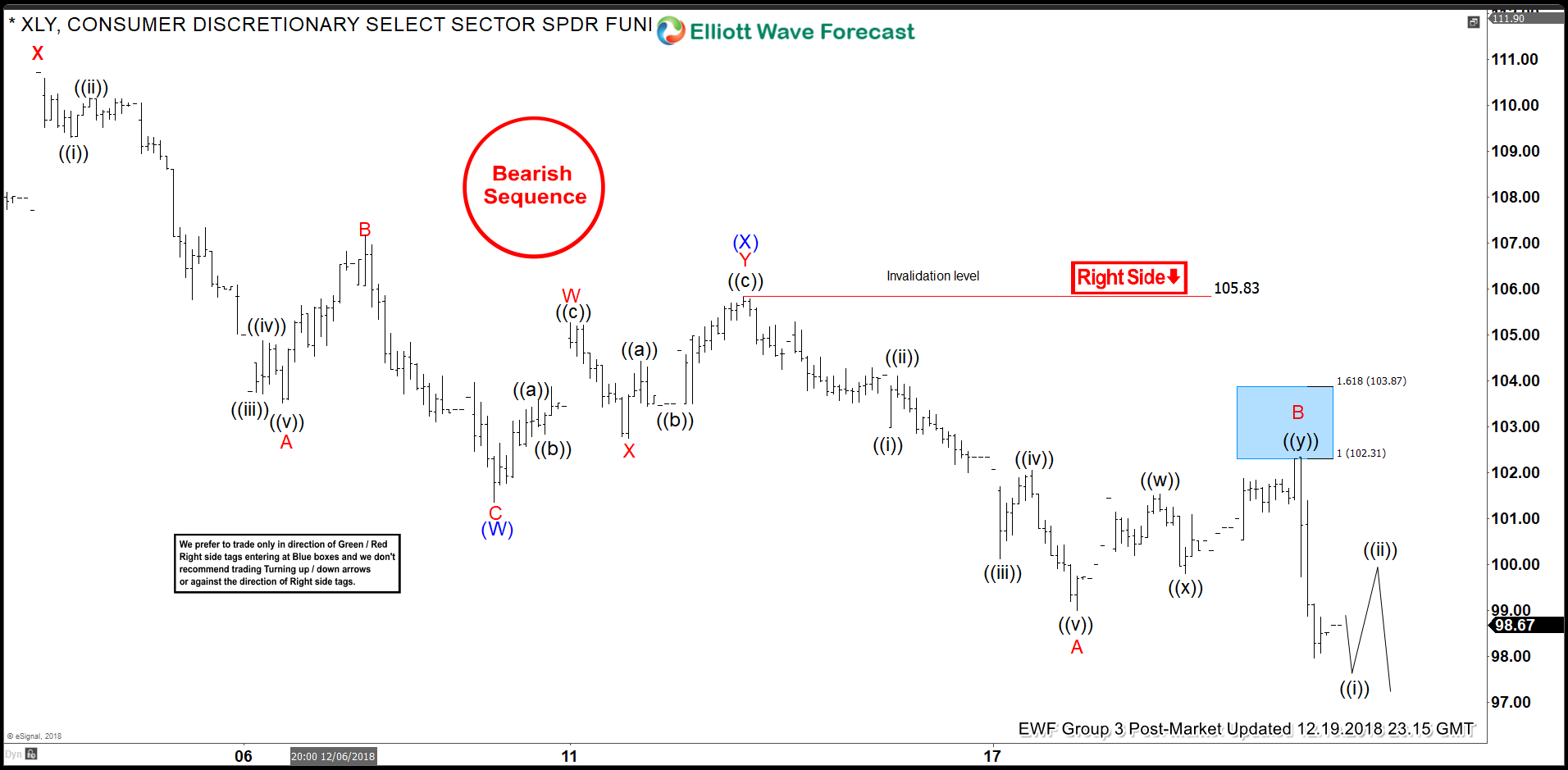

The 12/19/2018 Post Market Chart of XLY After The FOMC

The post-market chart above shows what happened to prices of XLY at the blue box. Prices hit a high of 102.33 on 12/19/2018 at 2:01 PM EST and instantly fell to 99.73 before briefly bouncing. The 102.25 entry was never more than a mere 0.08 negative and our traders were able to remove risk on the trade by 2:45 PM EST.

Wishing you a very Merry Holiday Season,

James

EWF Analytical Team