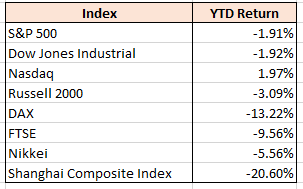

Global Indices continue to retreat in the fourth quarter of this year as the combination of Fed’s quantitative tightening and escalating trade wars threatens to derail the 10 year bullish market. Below is the Year-to-Date return of the Global Indices as of Friday Nov 24:

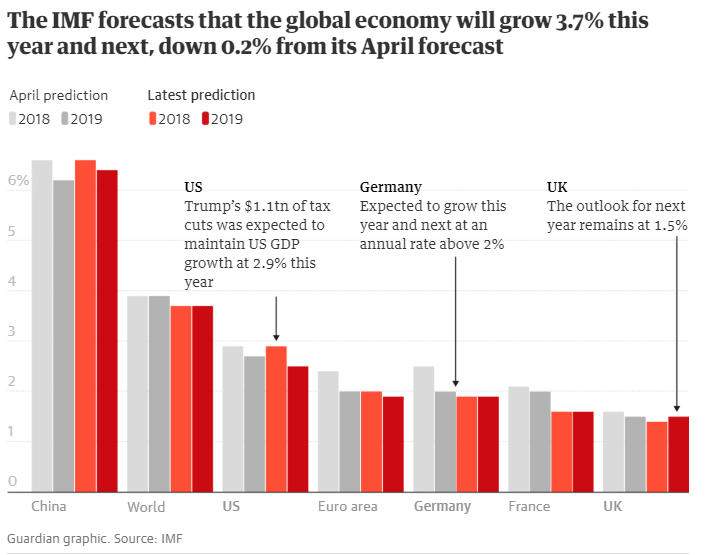

Next week, global Indices will have a chance to find support if the U.S. and China are able to bridge their differences in G20 meeting. Beijing and Washington have engaged in an escalating tit-for-tat trade war since this summer. The U.S imposed tariffs on Chinese goods worth US $250 billion per year, while China imposed tariffs on U.S. goods worth US $110 billion. The IMF warned that rising trade tensions could cost the global economy $430 billion and lower global growth by as much as 0.5% by 2020.

President Trump and Xi will meet on the sidelines on Nov 31 and Dec 1 in Argentina at G20 summit to try to strike a deal. President Trump has threatened to increase the tariffs on $200 billion Chinese imports from 10% – 25% starting January next year if there’s no agreement. On the other hand, China does not show any willingness to bend the knee and lose face. The summit will be an opportunity to broker ceasefire and avoid further escalation, although it remains to be seen if it can reverse the previously announced tariffs.

Should there be a truce made, global Indices can see support after the current selloff is over and see at least a 3 waves rally. However, if the meeting fails to produce any deal, then global Indices could continue to see weakness until the end of the year.

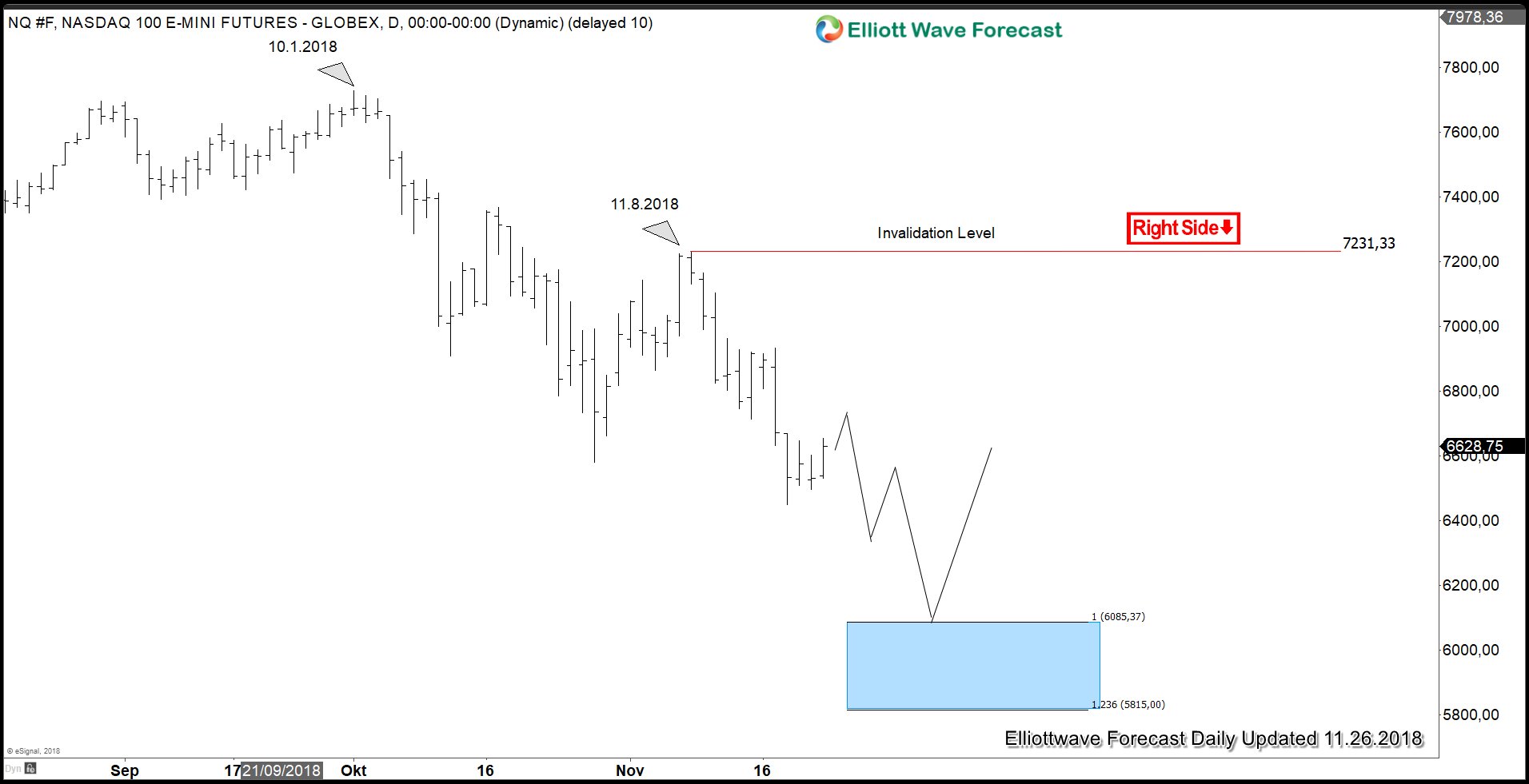

Nasdaq Daily Outlook suggests lower stock market

Despite still showing positive YTD return, Nasdaq has pull back 16% from the peak of 2018 in less than 2 months. The Index shows incomplete bearish sequence from 10.1.2018 high favoring further downside to 5815 – 6085 blue box as far as near term rally stays below 7231.3. We should expect the Index to continue lower next week towards the blue box. If the Index has reached the box prior to the G20 meeting and the outcome is positive, then it can trigger at least a 3 waves rally from the box to at least correct the decline from 10.1.2018 peak.

Nasdaq Short Term Elliott Wave Outlook

Nasdaq shows an incomplete bearish sequence from 10/1 peak (7728.7) as indicated by the bearish sequence stamp and red color right side stamp on the charts. Decline from 10/1 peak is unfolding as a double three Elliott Wave structure where Cycle degree wave W ended at 6580.5 and Cycle degree wave X ended at 7231. Minor wave Y remains in progress, and down from 7231, Primary wave ((W)) ended at 6712.25 and Primary wave ((X)) ended at 6938.99. Near term, while bounces stay below there, and more importantly below 7231, expect the Index to extend lower.