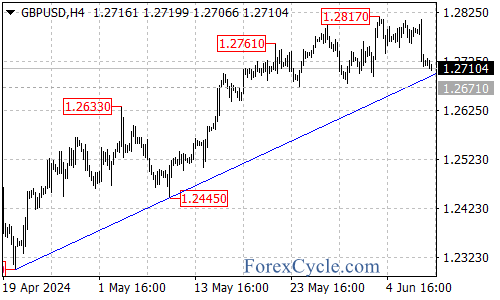

The GBPUSD currency pair has been trading sideways in a range between 1.2671 and 1.2817 for several weeks, with the pair now facing the support of the rising trend line on the 4-hour chart.

Consolidation for Uptrend

As long as the trend line support holds, the sideways move could be viewed as consolidation for the broader uptrend that originated from the 1.2299 low on April 22nd.In this scenario, further gains toward the 1.2900 area are still possible after the current consolidation period.

Key Resistance Levels

In the near-term, the first level of resistance to watch on the topside is the 1.2750 area. A breakout above this level could potentially trigger another rise to test the 1.2817 resistance.If buyers can push the GBPUSD above 1.2817, the next key target would be the 1.2900 area.

Key Support Levels

On the flip side, the key support level to watch is the 1.2670 area. A breakdown below this level would likely indicate that the upside move from 1.2299 has completed at 1.2817 already.In this scenario, the next key downside target would be the 1.2600 area, followed by the 1.2525 area.

Levels to Watch

The key levels to watch in the GBPUSD are the 1.2670 and 1.2750 support and resistance areas, along with the 1.2817 and 1.2900 resistance levels.

As long as the pair remains above 1.2670 support, the overall technical bias will remain tilted to the upside, with the potential for a continuation move toward the 1.2900 area after the current consolidation.

However, a breakdown below 1.2670 and 1.2600 would be a significant technical event, likely opening the door for a deeper pullback toward the 1.2525 area.

The GBPUSD uptrend remains intact, with the pair currently consolidating within a trading range. Traders will want to closely monitor the price action around the key support and resistance levels highlighted to determine if the upside momentum will continue to build or if a more significant reversal could unfold.