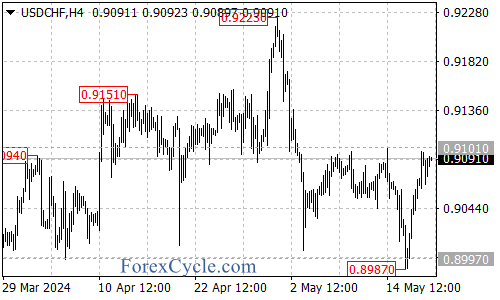

After testing the key 0.8997 support level, the USDCHF currency pair has rebounded from a low of 0.8987 and is now facing resistance at the 0.9101 handle. This area will likely determine the pair’s near-term directional bias.

Potential for Further Upside

A bullish breakout above the 0.9101 resistance could potentially trigger an upside continuation move in the USDCHF, with the next key target on the topside in the 0.9150 area.If buyers can push the pair above the 0.9150 barrier, it would open the door for a potential rally toward a retest of the 0.9223 previous high.

Key Support at 0.9050

While the technical outlook has shifted to a more bullish bias in the near-term, traders will want to keep a close eye on the 0.9050 area as initial support. A breakdown below this level could see the USDCHF retrace back toward the 0.8997 support zone.If the 0.8997 support gives way, it would likely signal a more substantial pullback, with the next key downside target in the 0.8890 area.

Levels to Watch

For now, the key levels to watch in the USDCHF are the 0.9101 and 0.9150 resistance levels, along with the 0.9050, 0.8997, and 0.8890 support areas.

As long as the pair remains above 0.9050 support, the near-term technical bias will remain tilted to the upside, with the potential for a continuation move toward the 0.9150 and 0.9223 resistance levels.

However, a breakdown below 0.9050 and 0.8997 would likely signal a bearish reversal, with the potential for a deeper pullback toward the 0.8890 support.

The USDCHF has rebounded from support but now faces a key test at the 0.9101 resistance barrier. The direction of the next big move will likely be determined by the pair’s ability, or inability, to clear this level in the sessions ahead.