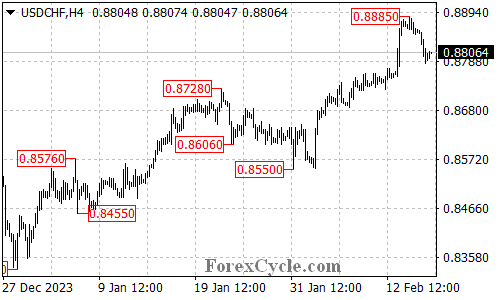

USDCHF’s recent rally encountered resistance at 0.8885, leading to a pullback that’s currently testing support at 0.8775. Let’s analyze the technicals to understand whether this is a temporary pause or a sign of a deeper decline.

Uptrend Consolidation or Downturn Signal?

- Support Test: If the 0.8775 support holds, the pullback could be considered a healthy consolidation within the uptrend that started from 0.8550. This could pave the way for another rise after the consolidation phase.

- Breakdown Warning: Conversely, a breakdown below 0.8775 would signal a potential reversal of the uptrend, indicating that the recent rise from 0.8550 might be over. In this scenario, the next support level to watch would be around 0.8650.

Key Resistance and Potential Upside

- Immediate Hurdle: If the bulls regain control and push the price back up, the initial resistance to overcome is at 0.8830.

- Further Upside Potential: Surpassing 0.8830 could trigger a continuation of the uptrend, potentially leading to a retest of the previous resistance at 0.8885.

- Ambitious Target: Breaking above 0.8885 would open the door for a move towards the 0.9000 area, suggesting further bullish momentum.

Overall Sentiment

The outcome of the price action around the current support and resistance levels will be crucial for determining USDCHF’s next move. Holding above 0.8775 reinforces the uptrend and potential for further gains. However, a breakdown below this level could indicate a trend reversal and potential decline towards 0.8650 or lower.