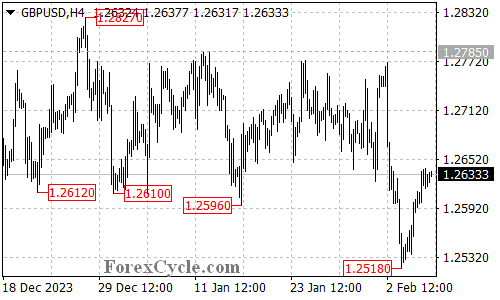

GBPUSD has shown signs of life, bouncing from its low of 1.2518 and reaching 1.2641. This begs the question: is this the start of a new rally, or just a temporary pause in the downtrend from 1.2827? Let’s delve into the technical picture to understand the potential scenarios.

Potential for Further Upside

- Current Momentum: The rise from 1.2518 suggests some buying pressure, and further upward movement towards the 1.2690 area remains a possibility.

Downtrend Might Resume Despite Bounce

- Crucial Resistance: If the rally stalls at 1.2690 and the price fails to break through, it could be interpreted as a consolidation within the overall downtrend.

- Retest of Support: In this scenario, a decline back to retest the 1.2500 support level might occur after the consolidation phase. A breakdown below this level could open the door for further decline towards the 1.2400 area.

Upside Breakout Would Signal Trend Shift

- Breaking Barriers: Conversely, a decisive break above the 1.2690 resistance would paint a significantly different picture.

- Trend Reversal: Such a breakout would suggest that the downtrend might have ended at 1.2518, potentially paving the way for a retest of the previous resistance at 1.2785.

Overall Sentiment

GBPUSD’s recent bounce presents a mixed outlook. While further upside towards 1.2690 is possible, the overall downtrend remains in play. The price action around the 1.2690 level will be crucial. A breakout would signal a potential trend reversal, while a decline back below 1.2500 would confirm the continuation of the downtrend.