GBPJPY has seen an extension of its downside movement, suggesting an upcoming consolidation phase and potential range trading.

Downside Move Extension

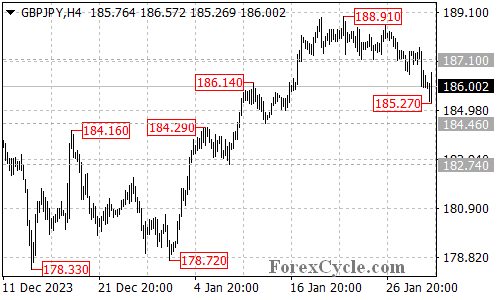

The GBPJPY pair has had its downward trajectory stretch from 188.91 to as low as 185.27.

Consolidation Phase

The recent bounce back suggests that a consolidation process for the downside move is currently unfolding.

Anticipated Range Trading

In the upcoming days, we can likely expect range trading between the levels of 185.27 and 187.00.

Downward Trajectory and Support Breach

Given the 187.00 resistance continues to be firm, we can expect the downward trend to resume. A further breakdown below the 185.27 support level could instigate another drop, potentially towards the 184.00 area.

Potential Upside Breakout

Conversely, a breakout of the 187.00 resistance might suggest that the downside move has reached its limit at 185.27. In this case, the subsequent target would likely be set at the 187.70 area.

In conclusion, while GBPJPY extends its downward movement and enters into a consolidation phase, both rebounds and breakout scenarios should be closely monitored.