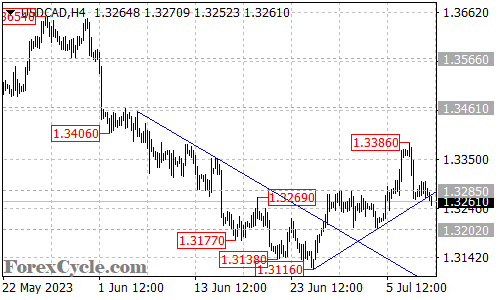

The USDCAD currency pair has experienced a significant development as it broke below the rising trend line on the 4-hour chart. This breach suggests that the upside move from 1.3116 has potentially completed at the recent high of 1.3386. Traders are now anticipating further downside movement in the coming days, with the next target set at 1.3202, followed by the previous low at 1.3116.

The break of the rising trend line is a strong bearish signal, indicating a potential shift in market sentiment. It suggests that selling pressure has intensified, and traders may look to capitalize on the downward momentum. The breach also serves as a confirmation that the recent bullish phase has potentially come to an end.

Currently, immediate resistance is forming near 1.3320. For a renewed upward move to occur, the price would need to surpass this resistance level. If successful, it could trigger another rise towards the previous high at 1.3386. However, until such a breakthrough is achieved, the bearish outlook remains dominant.

In summary, the USDCAD pair has broken below its rising trend line, suggesting a potential completion of the upside move from 1.3116. Further decline is expected, with the next targets at 1.3202 and 1.3116. Immediate resistance is at 1.3320, and a break above this level would be required to reignite bullish momentum. Traders should closely monitor price developments and adjust their strategies in response to evolving market conditions.