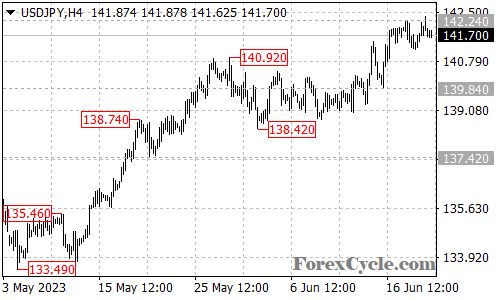

The USDJPY currency pair has experienced a significant breakthrough, surpassing the resistance level at 142.24 and extending its upside move from 138.42 to a high of 142.36. This breakout suggests that the pair’s bullish momentum remains intact.

As long as the support level at 140.92 holds, the upside move in USDJPY is expected to continue. Traders should closely monitor price action, as the next target for the pair is projected to be around the 145.00 area. This level could serve as a significant psychological and technical resistance.

However, it is important to consider the potential for a downside correction. If the price fails to maintain above the support level at 140.92, a breakdown could occur, leading the pair back towards the next support level at 139.84. Further downside movement could then target the previous low at 138.42.

To summarize, USDJPY has broken above the resistance level at 142.24, indicating a continuation of the bullish momentum. With the support level at 140.92 intact, the next target for the pair is projected to be around the 145.00 area. However, a breakdown below 140.92 could lead to a potential downside correction towards 139.84 and 138.42. Traders should carefully assess market conditions and monitor key factors to navigate the evolving dynamics of the USDJPY pair.