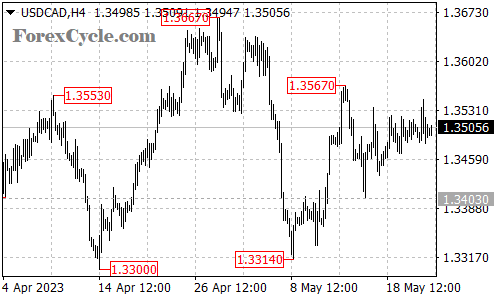

The USDCAD currency pair has managed to break above the resistance level at 1.3525, signaling a potential continuation of its recent upward movement. Traders can anticipate further upside momentum in the coming days, with the next target being the resistance level at 1.3567. A decisive breakthrough above this level could pave the way for a potential rally towards the 1.3667 resistance.

In terms of support, the near-term level to watch is at 1.3465. As long as the price remains above this support, the bullish bias is likely to persist. However, a breakdown below 1.3465 could lead to a retest of the next support level at 1.3403. Should the bearish pressure intensify, the price could aim for the 1.3300 support area.

The recent breakout above 1.3525 indicates a shift in market sentiment, with buyers taking control and driving the price higher.

To summarize, the USDCAD pair has broken above the resistance level at 1.3525, suggesting the potential for further upside movement. Traders can anticipate a rise towards the 1.3567 resistance, and a decisive breakthrough above that level could lead to further gains. However, it is important to monitor support levels, with 1.3465 as the near-term support to watch. A breakdown below this level might signal a shift in market sentiment. Implementing effective risk management strategies is vital to navigate the USDCAD market successfully.