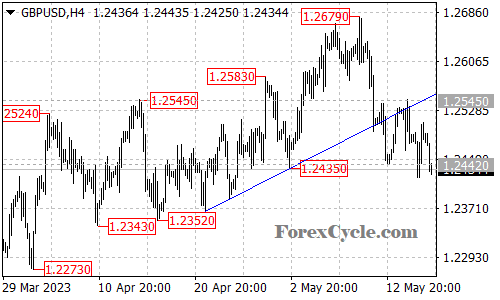

The GBPUSD pair has encountered a significant development as it broke below the key support level at 1.2442. This break suggests that the downtrend from the previous high of 1.2679 has resumed, indicating a shift in the market sentiment towards bearishness.

With the support level breached, market participants should anticipate further declines in the GBPUSD pair. The next target for the bears lies at 1.2350, followed by 1.2280. These levels could potentially act as additional support zones and attract buying interest, leading to a temporary pause or potential reversal of the downward movement.

On the upside, the immediate resistance to monitor is located at 1.2545. A decisive break above this level would indicate a potential shift in the bearish momentum and could open the door for another upward move towards the 1.2700 level. Until such a breakout occurs, however, the prevailing downtrend remains intact.

Traders are advised to closely observe price action and monitor any interactions with key support and resistance levels. These levels can provide valuable insights into potential entry and exit points for trades. Additionally, staying informed about market news and economic events that may impact the GBPUSD pair can help traders make well-informed trading decisions.

In summary, the GBPUSD pair has broken below the support level at 1.2442, signaling the resumption of the downtrend from 1.2679. Further declines are likely, with the next targets at 1.2350 and 1.2280. The immediate resistance stands at 1.2545, and a break above this level could trigger a potential bullish reversal. Traders should remain vigilant and adjust their trading strategies accordingly, taking into account the evolving market conditions in the GBPUSD pair.