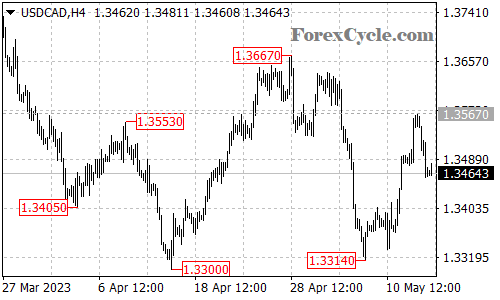

The USDCAD pair has experienced a significant break below the key support level at 1.3475, signaling a potential shift in market sentiment. This development suggests that the short-term uptrend from 1.3314 has likely reached its completion point at 1.3567. As a result, traders should be prepared for another potential decline towards the 1.3300 level in the coming days.

The break below the support level at 1.3475 has shifted the outlook for USDCAD to a more bearish bias. This downward movement indicates a potential continuation of the recent bearish momentum. Traders should closely monitor the price action and key support and resistance levels to identify potential entry and exit points.

In terms of immediate support, the USDCAD pair may encounter further downside pressure as it heads towards the 1.3300 level. This area is expected to act as a significant support zone and may attract buyers looking to take advantage of potential price reversals. However, should the pair breach below this support level, it could pave the way for further declines.

On the upside, the USDCAD pair faces resistance at 1.3567, which marks the recent high. To invalidate the bearish scenario and potentially signal a reversal in trend, the pair would need to break above this resistance level convincingly. Such a breakout could trigger renewed buying interest and potentially propel the pair towards the 1.3700 level.

In conclusion, the USDCAD pair has broken below the support level at 1.3475, indicating a potential shift towards further downside movement. Traders should be prepared for a possible decline towards the 1.3300 level in the coming days. Resistance is now at 1.3567, and a break above this level would be required to negate the bearish scenario. Implementing sound risk management practices and staying informed about market developments will be crucial for trading success in the USDCAD market.