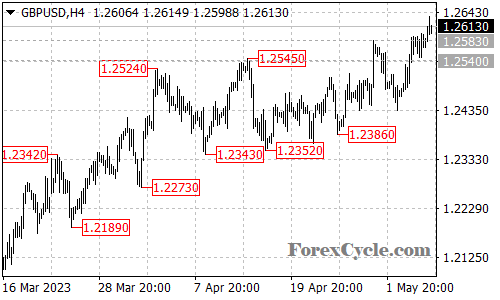

The GBP/USD pair has been in an uptrend since hitting a low of 1.1802 in March. Recently, the pair has broken above a key resistance level at 1.2583, indicating that the uptrend has resumed.

With the resistance level now broken, the next target for the GBP/USD pair is the 1.2700 area. This is a level that hasn’t been seen since early April and would mark a significant move higher for the currency pair.

However, it’s important to note that the GBP/USD pair could face some resistance on the way up. Near term support is at 1.2540, and if the pair falls below this level, it could bring the price back towards 1.2400.

Despite this possibility, the overall trend remains bullish for the GBP/USD pair. If the price does continue to rise, it could be a sign of strength in the pound and a positive development for traders who are bullish on the currency.

Overall, the GBP/USD pair has shown strength in recent weeks and months, and the break above 1.2583 suggests that the uptrend could continue. However, traders should be aware of potential resistance levels along the way and monitor the pair closely for any signs of a reversal.