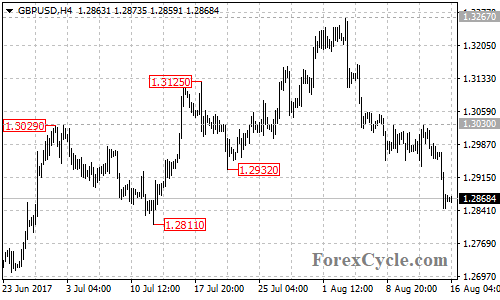

GBPUSD extended its bearish movement from 1.3267 to as low as 1.2845, facing the bullish support trend line on the daily chart. A clear break below the trend line support could take price to next support level at around 1.2600. Resistance levels are at 1.2930 and 1.3030, as long as these levels hold, the downtrend will continue.