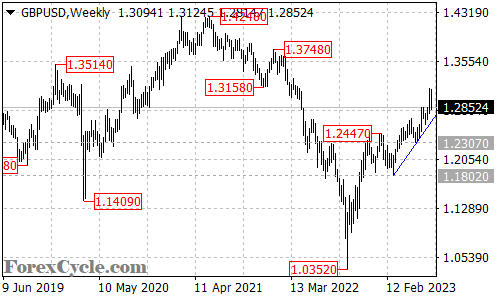

GBPUSD has demonstrated its resilience on the weekly chart, remaining above the rising trend line and sustaining its long-term uptrend from 1.0352.

Market analysts and traders are closely monitoring this upward movement, with expectations of further gains in the currency pair. The next notable targets are projected to be 1.3750, followed by 1.4248, which represents the previous high. As long as the trend line support holds firm, the path for GBPUSD seems paved for continued upside momentum.

Given the current outlook, traders are closely monitoring the critical trend line support. As long as this support level remains intact, the bullish momentum is expected to persist. Traders are encouraged by the prospect of further appreciation in the currency pair and are actively planning their trading strategies to capitalize on reaching the 1.3750 and 1.4248 targets.

However, it is essential to exercise caution and be prepared for potential downturns. A breakdown below the trend line support could indicate the completion of the uptrend, potentially leading to a corrective phase. In such a scenario, GBPUSD is likely to find support at 1.2307, followed by 1.1802.

While the current sentiment remains bullish, traders are advised to remain vigilant and closely monitor price movements. Short-term fluctuations may occur, and risk management strategies should be employed to navigate potential downside risks.

In conclusion, GBPUSD continues to demonstrate strength, staying above the rising trend line and maintaining its long-term uptrend from 1.0352. The currency pair’s outlook remains positive as long as the trend line support holds, with targets set at 1.3750 and 1.4248. Conversely, traders should be cautious and prepared for a potential breakdown below the trend line, which could lead to support levels at 1.2307 and 1.1802. As market conditions evolve, investors are eager to observe GBPUSD’s performance and seize opportunities presented by this resilient currency pair.