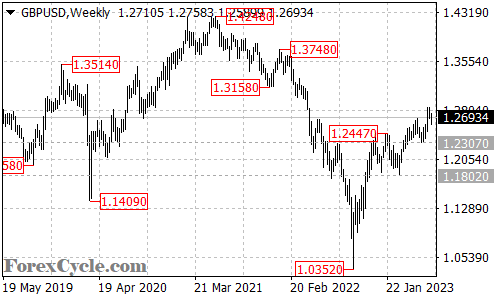

The GBPUSD currency pair has been displaying a resilient long-term uptrend, which initiated from the 1.0352 level. As the pair continues to climb higher, traders are closely monitoring key support and resistance levels for potential trading opportunities.

The immediate focus is on the key support level at 1.2307. As long as this support holds, the upside momentum in the pair is expected to persist, maintaining the long-term uptrend. Traders and investors will be monitoring the price action near this support level for any signs of a bounce or consolidation. If the support holds, it could potentially pave the way for a continued move higher.

In such a scenario, the next target for GBPUSD would be around the 1.3200 area. This level represents a significant resistance region where traders may anticipate increased selling pressure. Breaking above this resistance could fuel additional bullish momentum and attract further buying interest, potentially pushing the pair to higher levels.

On the downside, a breakdown below the 1.2307 support level could raise concerns about the strength of the uptrend. Such a bearish move might lead to a retracement or a more significant correction. Traders will be closely monitoring the price action and looking for confirmation signals before adjusting their positions. A sustained break below 1.2307 could potentially lead to a test of the next support level at 1.1802. A breach of this level would indicate a potential completion of the long-term uptrend.

In conclusion, the GBPUSD pair maintains its long-term uptrend from 1.0352. As long as the 1.2307 support level holds, traders can anticipate further upside potential, with the next target around 1.3200. However, a breakdown below 1.2307 would warrant caution, as it could indicate a potential shift in the market sentiment and lead to a deeper correction. Traders should closely monitor key levels and market dynamics to navigate potential trading opportunities in the GBPUSD market.