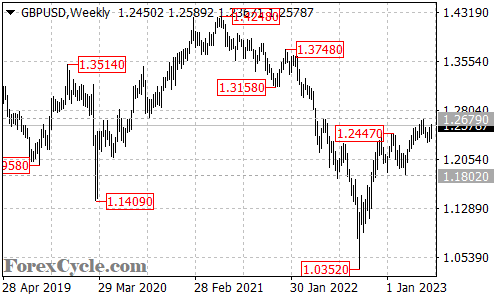

The GBPUSD currency pair has been undergoing a consolidation phase, suggesting a temporary pause in the long-term uptrend that originated from 1.0352. The pullback from the recent high of 1.2679 is likely a period of consolidation before the uptrend potentially resumes.

While the pair remains in consolidation, a deeper decline towards the 1.1802 support level cannot be ruled out over the next several weeks. Traders should closely monitor price action and key support levels for potential downside movements.

However, it is important to note that a break above the 1.2679 resistance level would indicate a resumption of the long-term uptrend. Such a breakout would be a bullish signal, suggesting further upward momentum in the GBPUSD pair. In this scenario, the next target could be around the 1.3200 area.

In summary, GBPUSD is currently in a consolidation phase within the context of a long-term uptrend. While a deeper decline towards 1.1802 support is possible, a breakout above 1.2679 would suggest a resumption of the uptrend, with a potential target near the 1.3200 area. Traders should carefully monitor price action and key levels to identify potential trading opportunities and manage risks effectively.