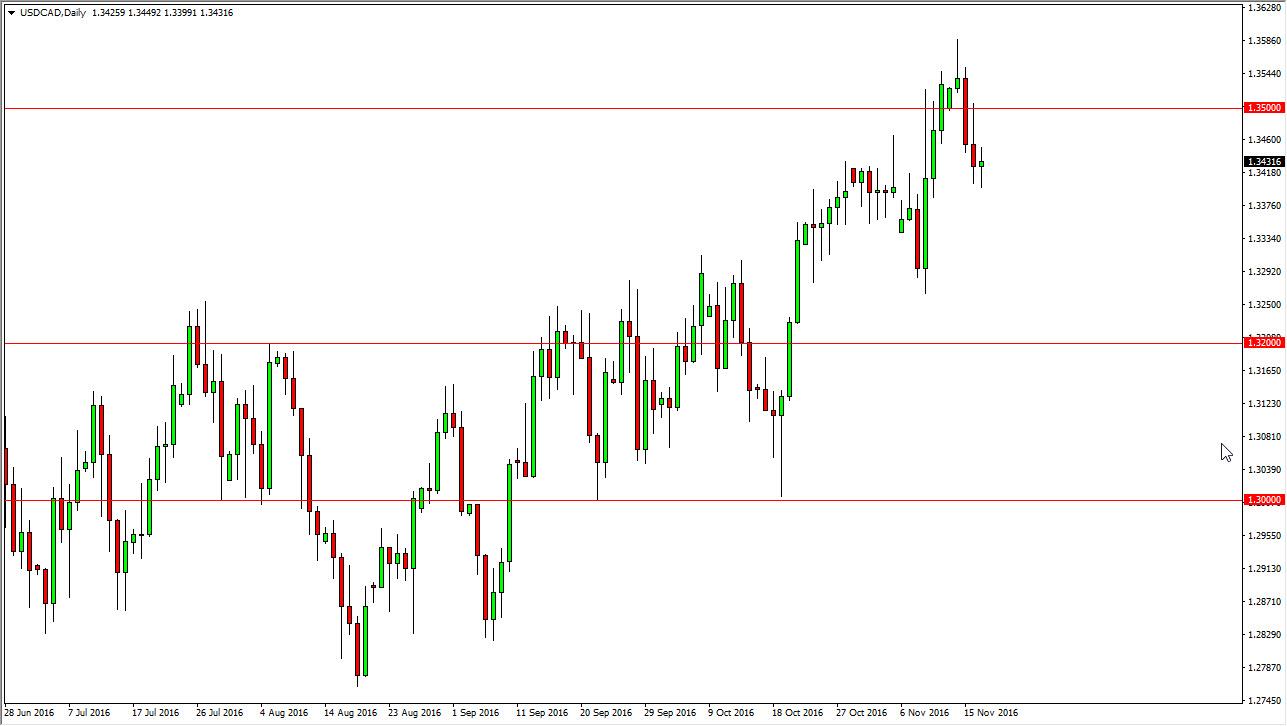

The USD/CAD pair went back and forth on Thursday as we found a bit of support at the 1.34 level below. I think that the market should continue to go higher, perhaps reaching towards the 1.35 handle on a break above the top of the candle. Pay attention to the oil markets, because if they continue to show weakness and fall which they do look likely to, we could see this market accelerate to the upside and perhaps even break above the 1.35 handle given enough time. I have notched in shorting this market, the oil markets are too soft and of course the Canadian economy hasn’t exactly been white-hot lately either.

Looking at this market from a longer-term perspective, there’s an argument to be made for an up trending channel that has been very reliable, and as a result I feel that the buyers will return regardless as technically this market looks very bullish. I think that this market continues to offer value on pullbacks and therefore that’s how I will treat it as it moves going forward. I think that the longer-term outlook for the US dollar is stronger anyway, and as long as oil is soft there’s no way that this market is going to turn around for any real length of time.

The 1.40 level above is the longer-term target going forward, which of course is a large, round, psychologically significant number. The market seems to have a bit of a “floor at the 1.33 handle below, and therefore I don’t think that we will be a will to go any lower than that anyway. This of course is all predicated upon the idea that the oil markets don’t suddenly spike to the upside, but at this point in time it looks very unlikely to happen so therefore I am fairly confident of this pair going higher and reaching to the upside. Adding fuel to the fire is the fact that the Federal Reserve looks likely to raise interest rates fairly soon, and most certainly much sooner than the Bank of Canada.