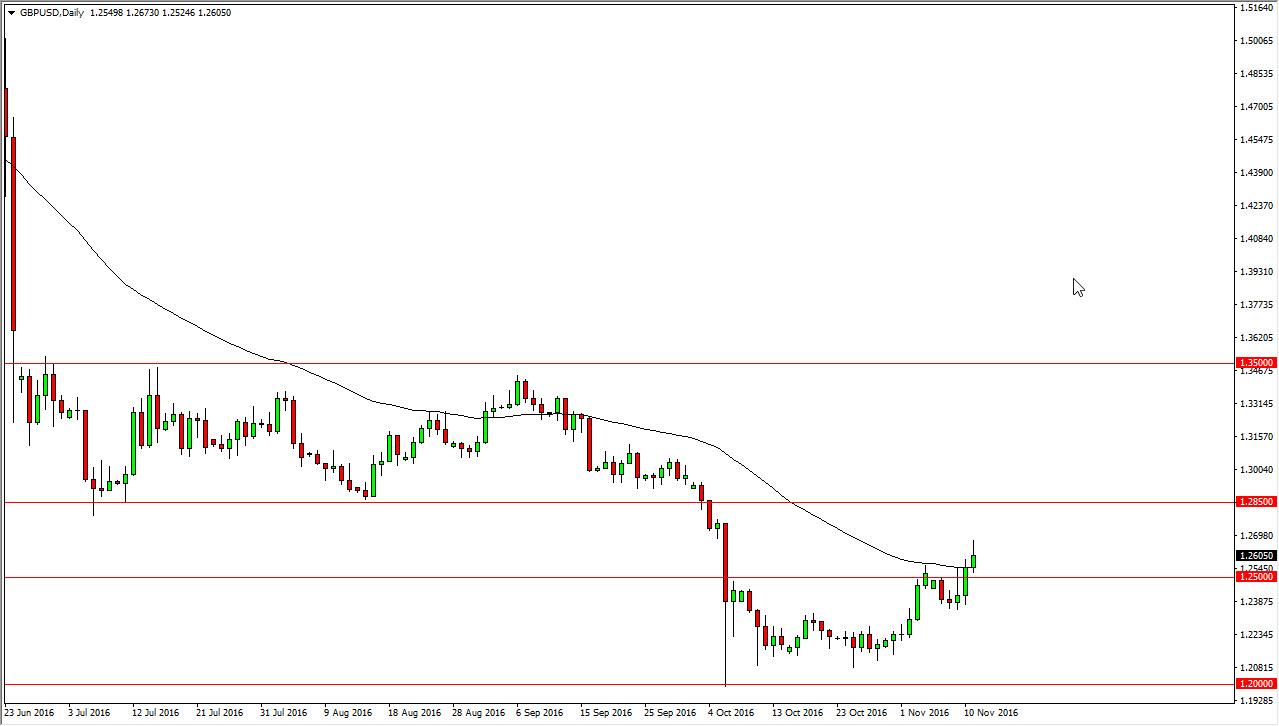

The GBP/USD pair ended up rally again at the open on Monday, but then turned around to form a shooting star like candle. It looks as if we are starting to show signs of exhaustion, but we need to break down below the 1.25 level in order for me to feel comfortable shorting. The 50-day exponential moving average is sitting at the bottom of the candle as well, and if we can break down I think that the longer-term trend will continue to the downside. Alternately, we could break above the top of the shooting star, but that should only be a short-term buying opportunity as the 1.2850 level above looks very resistive. At that point, I have no interest in being involved in this market to the upside, because I see so much in the way of resistance to the 1.30 level above. Ultimately, we could break out above, but I’m looking to long-term charts in order to be convinced of a longer-term trend change.

If we do break down below the 1.25 handle, and more importantly the last swing low which I see as the 1.2350 level, the market could reach quite a bit lower, perhaps down to the 1.22 handle, and then eventually the 1.20 level. I believe that the 1.20 level below is going to be massively supportive, but we could break down below there and then start focusing on the 1.15 handle which I see as a massive support level off of the monthly charts. There will be quite a bit of volatility regardless, because there so much uncertainty when it comes to the United Kingdom and the exit vote that recently happened. Because of this, I think that it’s difficult to be confident in the British pound. On top of that as well, the US dollar has been strengthening so I believe that any real move to the upside is going to have a limited shelf life if you will. It is much easier to short the British pound these days as far as I can see.