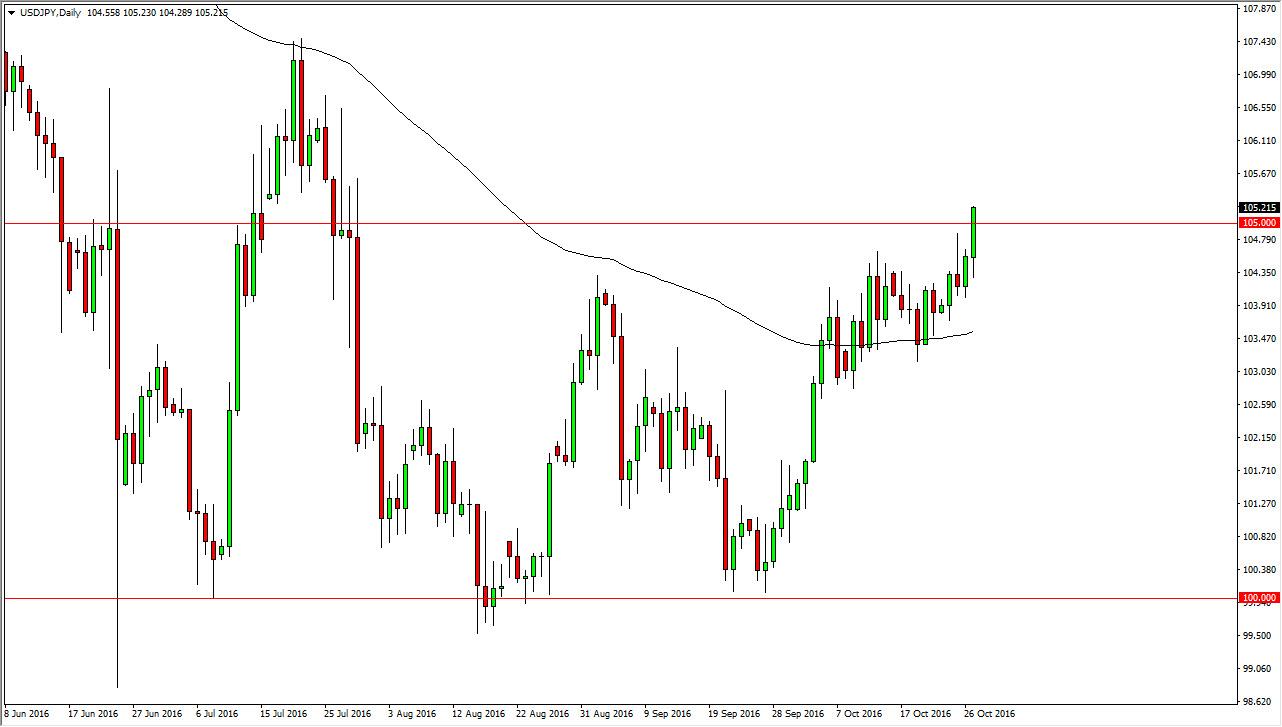

The USD/JPY pair initially tried to fall during the day on Thursday, but then shot higher and broke above the 105 level. This is an area that I have been talking about being the “ceiling” in this market for some time now, and as a result I feel that it’s only a matter time before the market reaches towards the 107 level above. On top of that, the 100-day exponential moving average has been supporting the market for the last couple of weeks, and now that we have broken out I believe that we will continue to go much higher given enough time. I believe that the US dollar will continue to strengthen overall, mainly because the Federal Reserve looks likely to raise interest rates at least once this year, so with that it makes sense that it would continue to go much higher against the Japanese yen.

The candle of course is fairly strong as well, so I do believe that this is the real thing. There is a significant amount of resistance above at the 107 level, so I think that we will struggle once we get up there and I don’t necessarily believe that we’re going to shoot straight to the upside. Pullbacks will be supported all the way down to at least the 103 level, so at this point in time I have no interest whatsoever in selling this market as I believe that the Bank of Japan looks very likely to intervene if the market breaks down too much, even possible intervention given enough time. On top of that, we could get further quantitative easing out of the Bank of Japan, and of course verbal intervention. With this, the market looks as if it is a bit of a “one-way trade”, so you will of course have to approach the market as such. I think that the longer-term trend will continue to be to the upside, but it’s going to be volatile overall. Pullbacks are to be bought going forward and careers could be made to the upside in this pair.