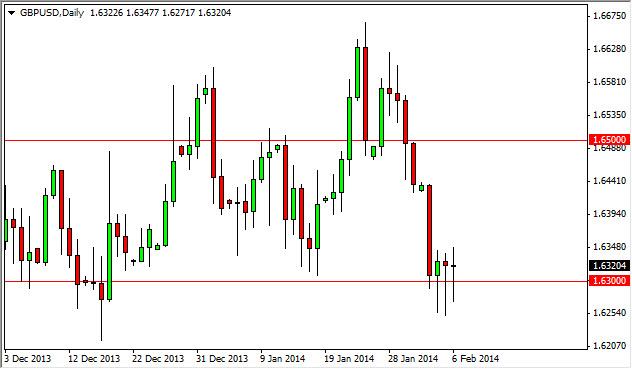

The GBP/USD pair fell below the 1.63 level for the third session in a row, and for the third session in a row turned back around and form a hammer. The three hammers in a row of course signifies significant support, and as a result it appears the markets probably going to pop higher. The 1.65 level is resistance above, but we do not think that the market will be held down by that level for too long. After all, it is an area that’s been sliced through a couple of times already. With that being said, we are bullish of the British pound, but do recognize the fact that today’s nonfarm payroll numbers will have an effect on the Forex markets in general. This pair of course will be no different.

We don’t have any scenario in which we sell this pair, simply because the British pound has been so strong against most currencies. Granted, the US dollar is stronger than most of the other currencies out there, but at the end of the day we think that this is more a story of British pound strength than anything else. We like buying every time this pair dips, and do eventually expect to see a 1.70 level printed current course of the next couple of months. The downside is protected rather vigorously as you can see by the triple hammers, which of course is a very rare sighting. The fact that it is at such a significant support level of course lends credence to the idea that perhaps traders have already decided that this pair is going to go higher, and that is only a matter of time. In fact, one has to wonder whether or not people haven’t started buying to get ahead of the numbers?

Even if we broke down, we still see pretty significant support down to the 1.62 handle, which showed itself to be so supportive in the middle of December. With that being said, we are buyers only in this market, and will continue to be so for the foreseeable future.