In this technical blog, we will look at the past performance of the Elliott Wave Charts of the Facebook ticker symbol: META. We presented to members at the elliottwave-forecast. In which, the rally from the October 2022 low ended as an impulse structure. But higher time frame charts supported more upside extension to take place as the main trend remains bullish to the upside. Therefore, we advised members not to sell the stock & buy the dips in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

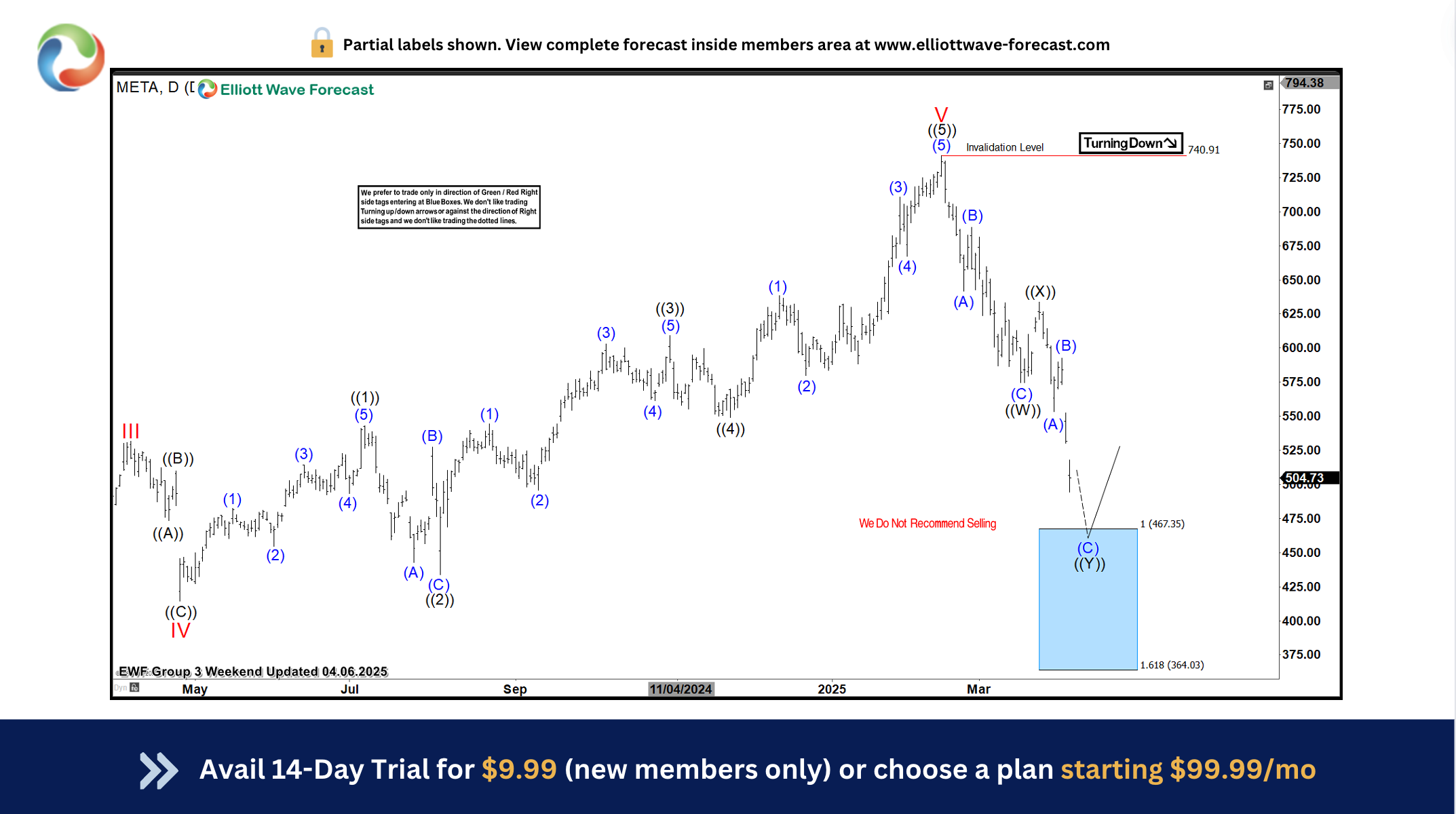

META Daily Elliott Wave Chart From 4.06.2025

Here’s the Daily Elliott wave chart from the 4.06.2025 Weekend update. In which, the cycle from the October 2022 low ended as an impulse structure at $740.91 high. Down from there, the stock made a pullback to correct that cycle. The internals of that pullback unfolded as Elliott wave double three structure where wave ((W)) ended at $574.66 low. While wave ((X)) bounce ended at $633.88 high. Then wave ((Y)) managed to reach the blue box area at $467.35-$364.03 equal legs area. From there, buyers were expected to appear looking for the next leg higher or for a 3 wave bounce minimum.

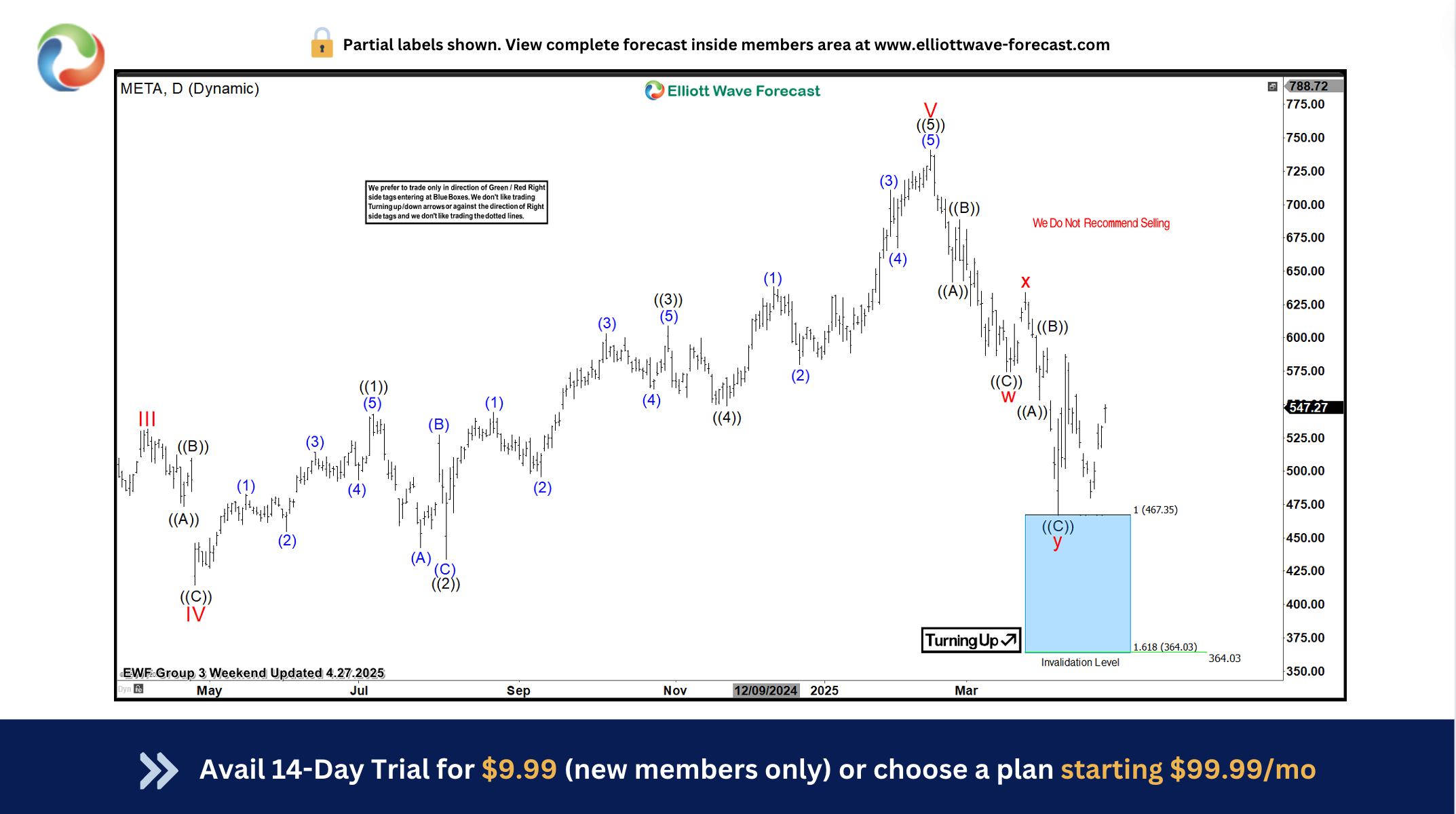

META Latest Daily Elliott Wave Chart From 4.27.2025

This is the latest Daily Elliott wave Chart from the 4.27.2025 Weekend update. In which the stock shows a reaction higher taking place, right after ending the correction within the blue box area. Allowed members to create a risk-free position shortly after taking the long position at the blue box area. However, a break above the $740.91 high is still needed to confirm the next extension higher & avoid a double correction lower.

Source: https://elliottwave-forecast.com/stock-market/blue-box-blog-meta-elliott-wave-reactions/