Hello Everyone! In today’s article, we will look at the Elliott Wave path of Goldman Sachs Group ($GS). We will explain why we believe more downside is coming for the stock and the financial sector as a whole.

Goldman Sachs ($GS) is an American multinational investment bank and financial services company. Founded in 1869, with regional headquarters in London, Hong Kong, Tokyo, Dallas and Salt Lake City, etc. Goldman Sachs is the second largest investment bank in the world by revenue and is ranked 57th on the Fortune 500 list of the largest United States corporations by total revenue. It is considered a systemically important financial institution by the Financial Stability Board.

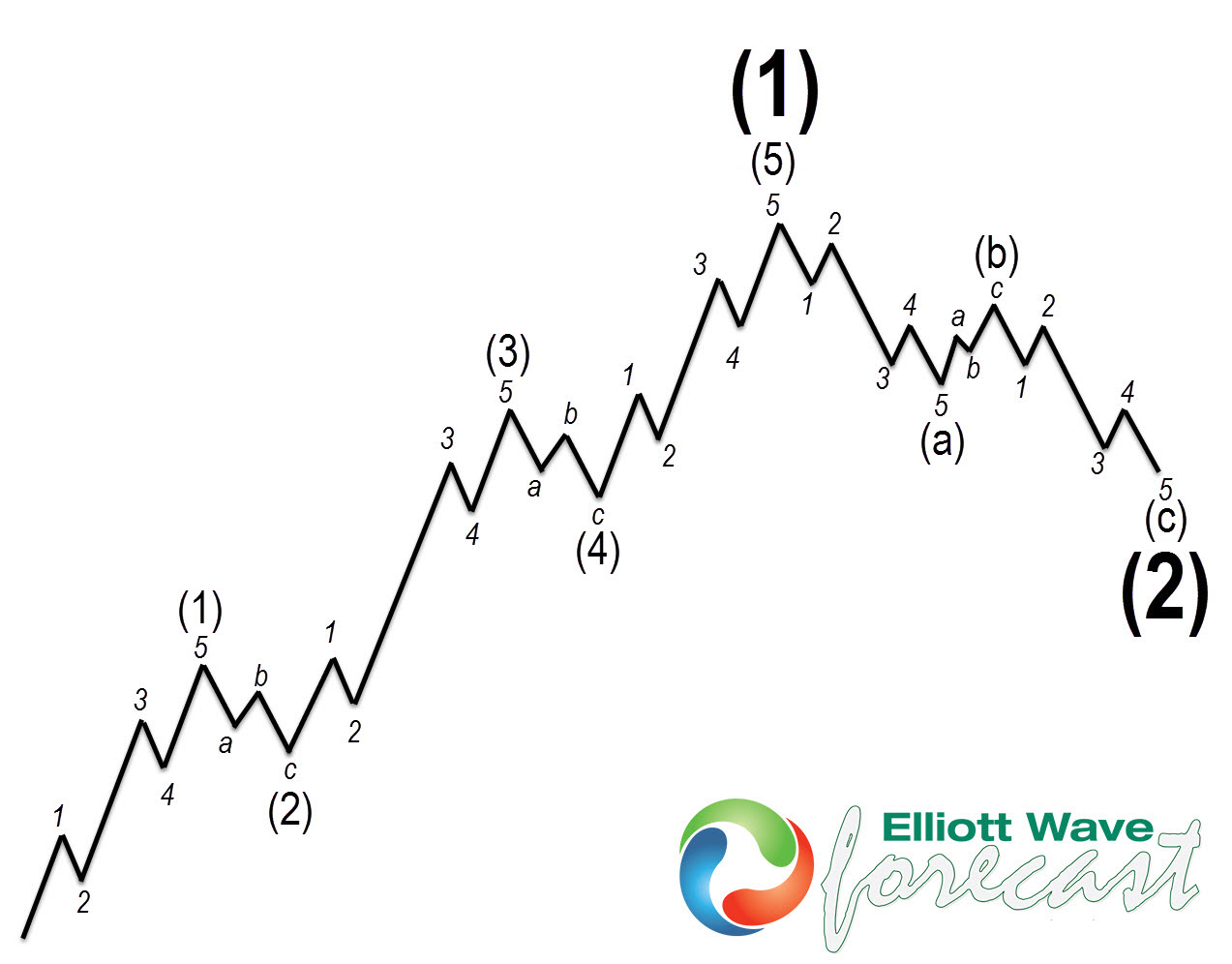

Elliott Wave 5 Waves Rally and 3 Waves Corrective Pattern

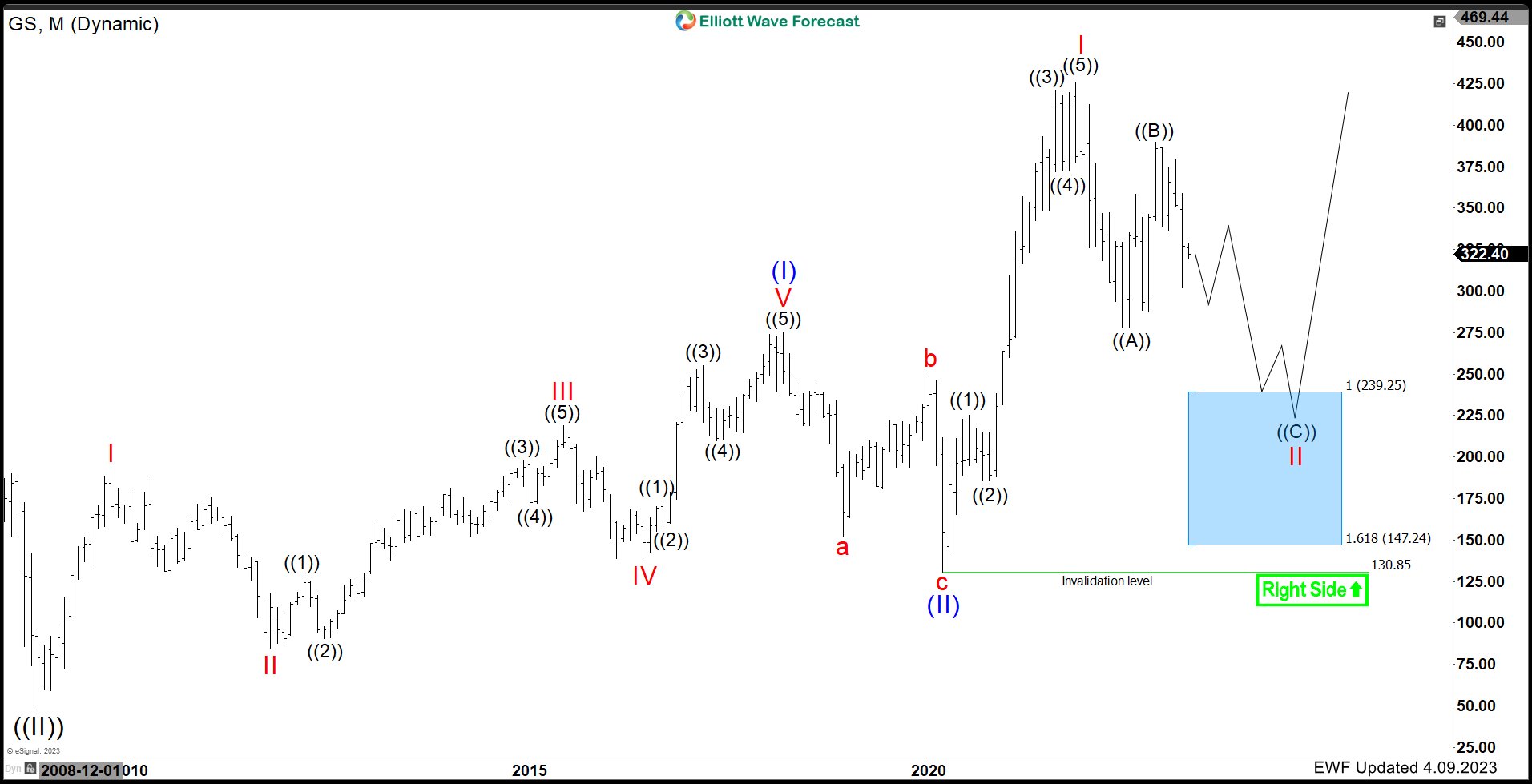

$GS Monthly Elliott Wave Analysis Aril 9th 2023:

The monthly chart above shows the rally from 2009 lows unfold in 5 waves and pullback in a 3 swing corrective pattern took place. The correction of the 2009 cycle ended in March 2020 at $130.85. Since March 2020, the stock rallied again in 5 waves breaking into a new all time high. That created a bullish sequence against March 2020 lows at $130.85. On Nov 2021, it ended the rally and is now pulling back to correct it in another 3 swing corrective pattern (ABC).

$GS Daily Elliott Wave Analysis Aril 9th 2023:

The daily chart above shows the price action since the peak on Nov 2021 at $426.16 which ended the cycle from March 2020. So far, the correction has unfolded in 5 waves to end the first leg in ((A)). The bounce took place in 3 swings and ended at ((B)). The next few months are going to be interesting because the stock should be looking to end 5 waves in blue (1). Expect a bounce in blue (2) and continuation lower towards the Blue Box area at $239.28 – 147.41 where we expect buyers to be appear for a reaction higher.

If you’ve been following EWF for a while, then you should know our motto by now which is: We like to buy dips in 3, 7 or 11 swings into blue boxes. That is a 3 swing pullback into a Blue Box area. Ideally, we would like to see a reaction higher to correct the decline from Nov 2021 and eventually a break above $426.16 into new all time highs in the next few years.