Silver (XAGUSD) is currently correcting cycle from 9.1.2022 low. Unsurprisingly, silver miners also see the same pullback. For Pan American Silver (PAAS), the pullback is still ongoing to correct cycle from 11.9.2022 low at 13.39. As long as this level holds, there’s a chance that the the stock can soon find support and turns higher. Below we update the outlook for the stock.

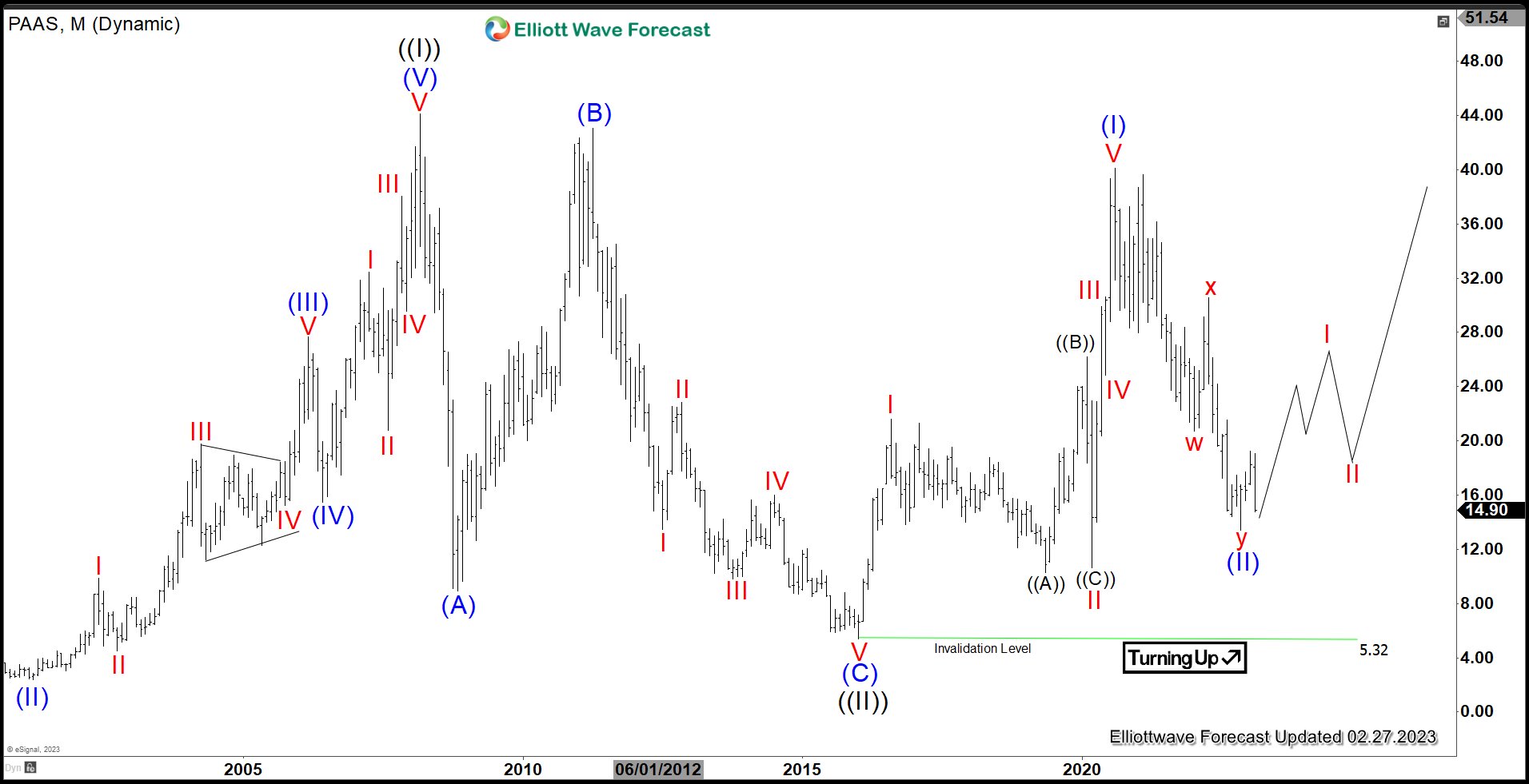

PAAS Monthly Elliott Wave Chart

Monthly chart of PAAS above shows that the stock has ended all-time correction with wave ((II)) at 5.32. Up from there, stock has rallied in a new impulsive bullish leg with wave (I) ended at 40.11. Wave (II) low is also proposed complete at 13.4 on November 2022. Stock should resume higher in the next months to come while above wave (II) low at 13.4, but more importantly above wave ((II)) at 5.32.

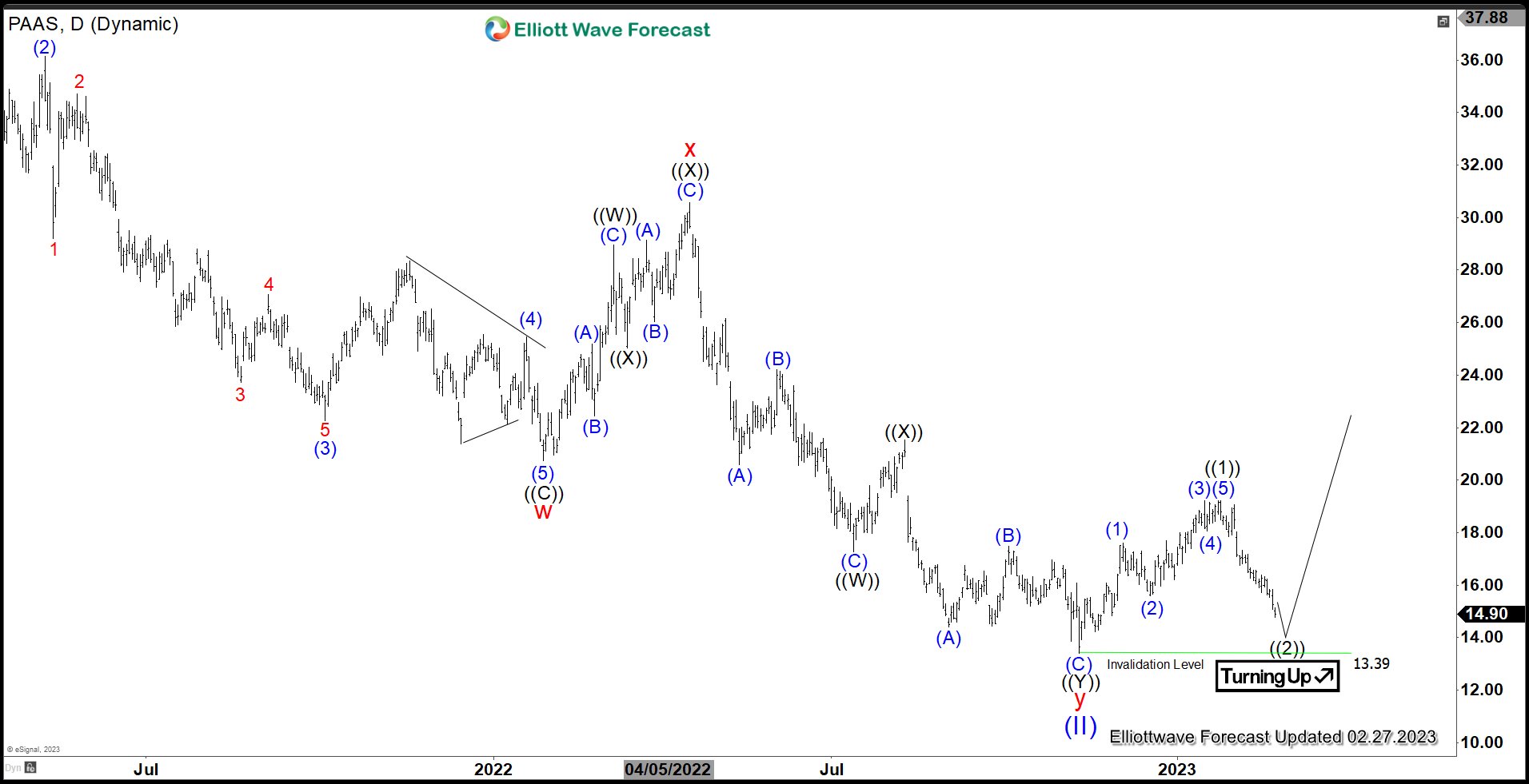

PAAS Daily Elliott Wave Chart

Daily Chart of Pan America Silver (PAAS) above suggests that the stock may have ended correction to cycle from January 2016 low at $13.39. We label this low as wave (II). Up from there, the stock has started a new leg higher as an impulse which ended wave ((1)) at 19.22. Pullback in wave ((2)) is in progress to correct cycle from 11.9.2022 low and can potentially retest this level at 13.39 before the stock turns higher. As far as pivot at 13.39 low stays intact, expect the stock to find support soon for the next leg higher.

Source: https://elliottwave-forecast.com/stock-market/pan-american-silver-paas-pullback-progress/