The long term fundamental background in the next few years for Uranium remains very good. With the world in energy crisis and in need of a green energy, Uranium offers an alternative source. One way to capitalize on this opportunity is with the Uranium Miners ETF (URA). The ETF invests on the Uranium itself as well as several mining companies in this sector.

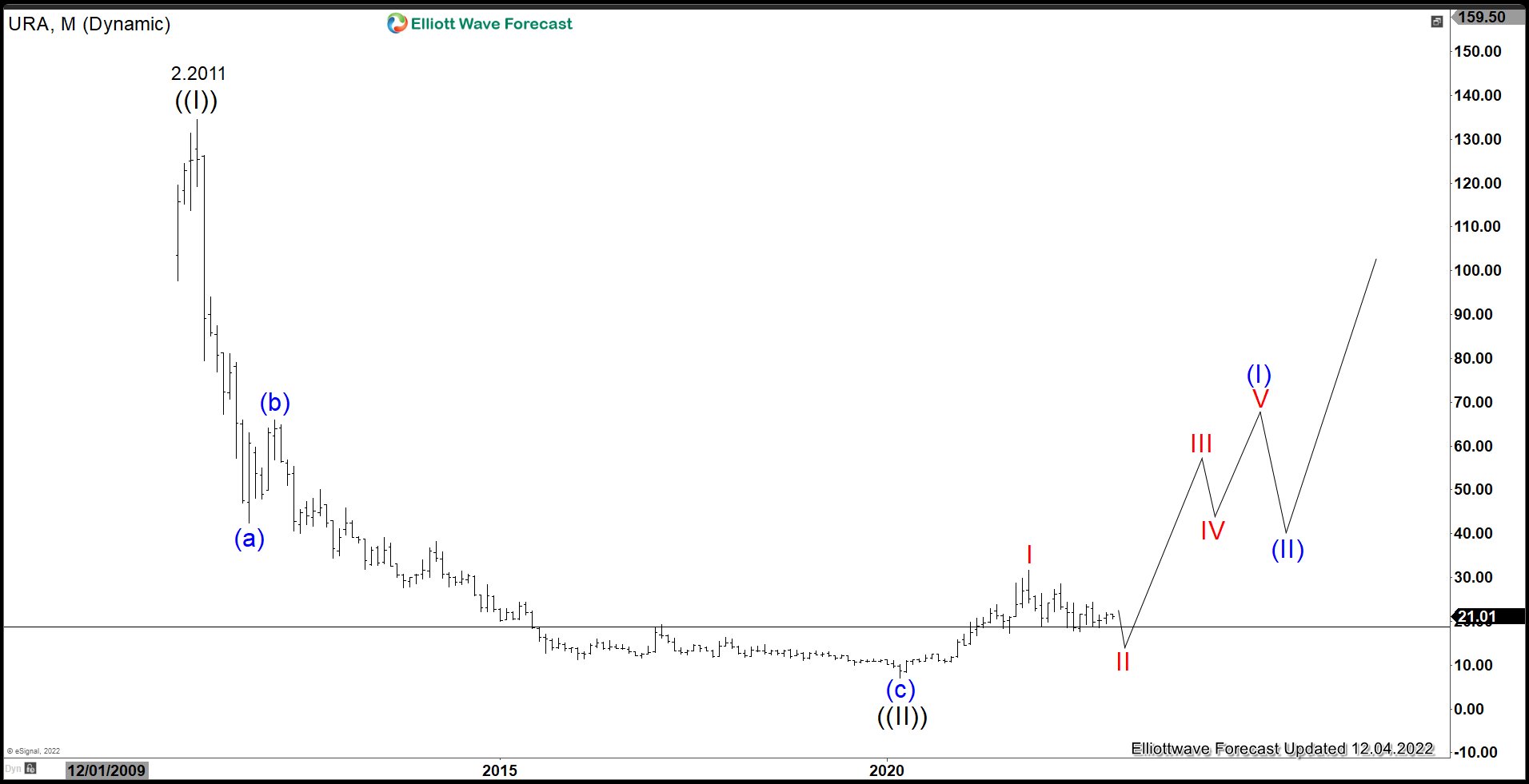

$URA Elliott Wave Chart Monthly Chart

Uranium ETF (URA) Monthly Chart above shows that the instrument is correcting cycle from March 2020 low within wave II. Pullback so far still has not shown any sign of bottoming. Structure of the instrument still hasn’t reached the ideal extension to end wave II. The weekly and monthly outlook however is bullish even though further downside still can’t be completely ruled out at this stage. Daily time frame below shows the ideal extension to end wave II.

$URA Daily Elliott Wave Chart

Daily Elliott Wave Chart of Uranium ETF (URA) above shows that wave II is in progress to correct cycle from 3.18.2020 low and the ideal target is a 100% extension from 11.9.2021 high which comes at 12.76 – 15.77. So far the instrument has not shown any sign of bottoming yet as it still continues to stay below the descending trend line. Near term, while below wave (X) at $24.34, it still has scope to extend lower towards $12.76 – $15.77 where strong buyers should appear. Break and close above the trend line however may suggest truncation and wave II to finish without reaching the full 100%.

Source: https://elliottwave-forecast.com/stock-market/uranium-etf-ura-still-not-confirmed-bottom/