Starbucks Corporation (SBUX) is an American multinational chain of coffeehouses and roastery reserves. It is the world’s largest coffeehouse chain. As of November 2021, the company had 33,833 stores in 80 countries, 15,444 of which were located in the United States. Out of Starbucks’ U.S.-based stores, over 8,900 are company-operated, while the remainder are licensed.

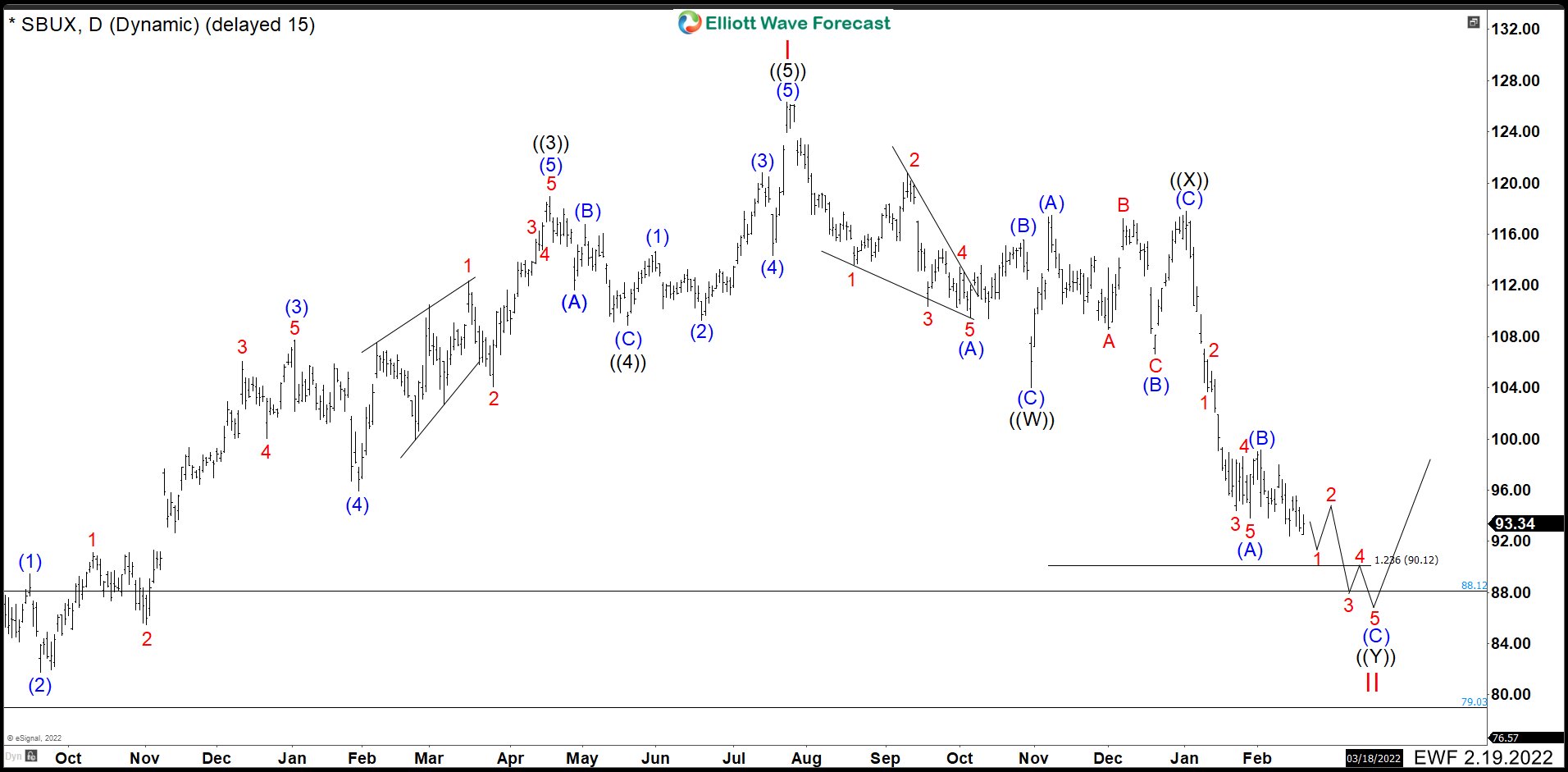

Starbucks ($SBUX) Elliott Wave Analysis – February Daily Chart

Starbucks (SBUX) completed an impulse structure from March 2020 low. It topped at $126.32 on July 2021. At that price, the stock started a correction of all cycle from March 2020. We can see from the peak a double correction, that means a ((W)), ((X)) and ((Y)) structure where each one is formed by 3 waves (A), (B), and (C) (If you want to learn more about Elliott Wave Theory, please follow these links: Elliott Wave Education and Elliott Wave Theory). The first 3 waves of ((W)) ended at 104.02, then we can see a pullback in 3 waves ending ((X)) at 117.80.

From here, we expected see 3 swings more down to complete a double correction. Wave (A) made an impulse ending at 93.79, then a shallow correction as wave (B) completed at 99.15. We were already in wave (C) and we were calling more downside looking for an impulse structure.

Starbucks ($SBUX) Elliott Wave Analysis – July Daily Chart

The impulse was lower than expected. The market built an extended ending diagonal. Down from wave (B), wave 1 ended at 78.92. Then bounce as a zig zag correction completed wave 2 at 92.42. Starbucks continued dropping ending wave 3 at 73.34. A fast bounce took place finish wave 4 at 82.84. This wave 4 rally got in the wave 1 area, that is why this wave (C) is an ending diagonal. Last move lower ended at 68.29 completing wave 5 of (C) and wave ((Y)) finishing the whole correction as wave II.

After this, market bounce to 81.27 and we are labeling as wave (1) and pullback as wave (2) ended at 70.29. Near term, while above 70.29 we are calling to complete an impulse higher as wave 1 then make 3 or 7 swings correction as wave 2 and then continue with the rally. We cannot rule out a rally in 3 or 7 swings correction only to reach the Fibonacci ideal area of 97.34 – 104.20 and then turning lower again.

Source: https://elliottwave-forecast.com/stock-market/starbucks-sbux-ended-correction/