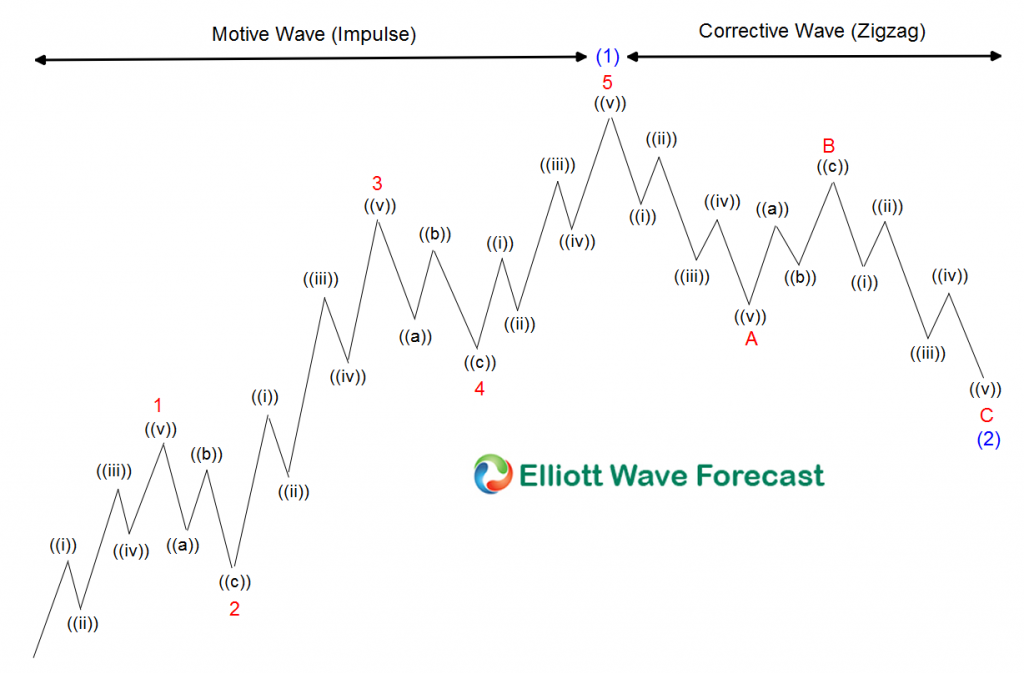

Chevron (CVX) has been trading in a huge up-trend since its inception in the market. The Symbol ended a Super-cycle degree back in 2014 and corrected for six years until it found buyers again in 2020. The Elliott Waves Theory basic rule is that the market trends in five waves and correct in three waves as following chart shows:

It shows the Five waves’ advance and the subdivisions within each impulse. Impulsive structure follows a sequence of 5-9-13-17-21. It is a powerful to trade with it, but also very dangerous when the market trades in the middle of the sequence.

Chevron from the all-time low is in the middle of a five waves advance, as we show in the following chart:

Quarterly Chevron Elliott Wave Chart

As we can see from above chart, the Grand Super Cycle is incomplete and now we are trading within wave (III). The wave (III) also comes with its own subdivision which we will show up in the Weekly chart below. However, we can see within the Grand Super Cycle that Chevron will be looking for the $187.00-$219.00 area to end wave (III) Blue. Then the stock should create a multi-year correction and more upside within wave (V) to end the Grand Super Cycle Five waves advance.

Chevron (CVX) Weekly Elliott Wave Chart

The weekly chart above shows the internals since the blue box area and the end of wave (II) back in 2020. Since the lows, the stock did a nest or a series of I –((1)) and then created separation to the upside. Presently we should be trading into the end of wave III red with a series of IV and V to reach the target within the higher degree (III). As we can see the market is represents a cycle and each cycle has its own sub-waves. Understanding the subdivision makes life easier for traders. Chevron can end wave III red at 100% since the all-time lows. Afterwards, a reaction lower should be happening to create another chance to buy.

In conclusion, we believe the uptrend in Chevron has years before the Grand Super Cycle ends. We recommend buying the dips in the corrective sequences in 3-7-11-15-19 and never selling the stock. Oil cycles, and very similar to Chevron, will benefit tremendously in the years ahead. Using The Elliott Wave Theory provides us with the map and helps us not to trade in the wrong side.