Precious metals and other commodities continue their bullish run as a result of inflationary pressure and war in Ukraine. In this article, we will take a look at Platinum. Platinum is considered as a precious metal. However, unlike gold, Platinum has industrial application. 75% of the worlds’ supply of gold is used in coins, bars and jewelry. Meanwhile, 65% of the world’s supply of Platinum is used for industrial and automotive applications. Only four countries have major platinum mining activities. South Africa has the most platinum deposits and accounts for 80% of global reserves. Below is a technical outlook of the metal.

Platinum Monthly Elliott Wave Chart

Monthly Elliott Wave outlook above suggests the rally from January 1992 ($329) ended Grand Super Cycle wave ((I)) at $2308. Up from January 1992 low, wave (I) ended at $466, and pullback in wave (II) ended at $334. The metal then resumes higher in wave (III) towards $1347 and pullback in wave (IV) ended at $1053. Final leg higher wave (V) of ((I)) ended at $2308 on March 2008. The metal then corrected for 11 years in wave ((II)) which ended on March 2020 low at $562. It has turned higher again in wave ((III)). Up from wave ((II)) low, wave (1) ended at $1348. Wave (II) is in progress as a zigzag to correct cycle from March 2020 low before the metal resumes higher again.

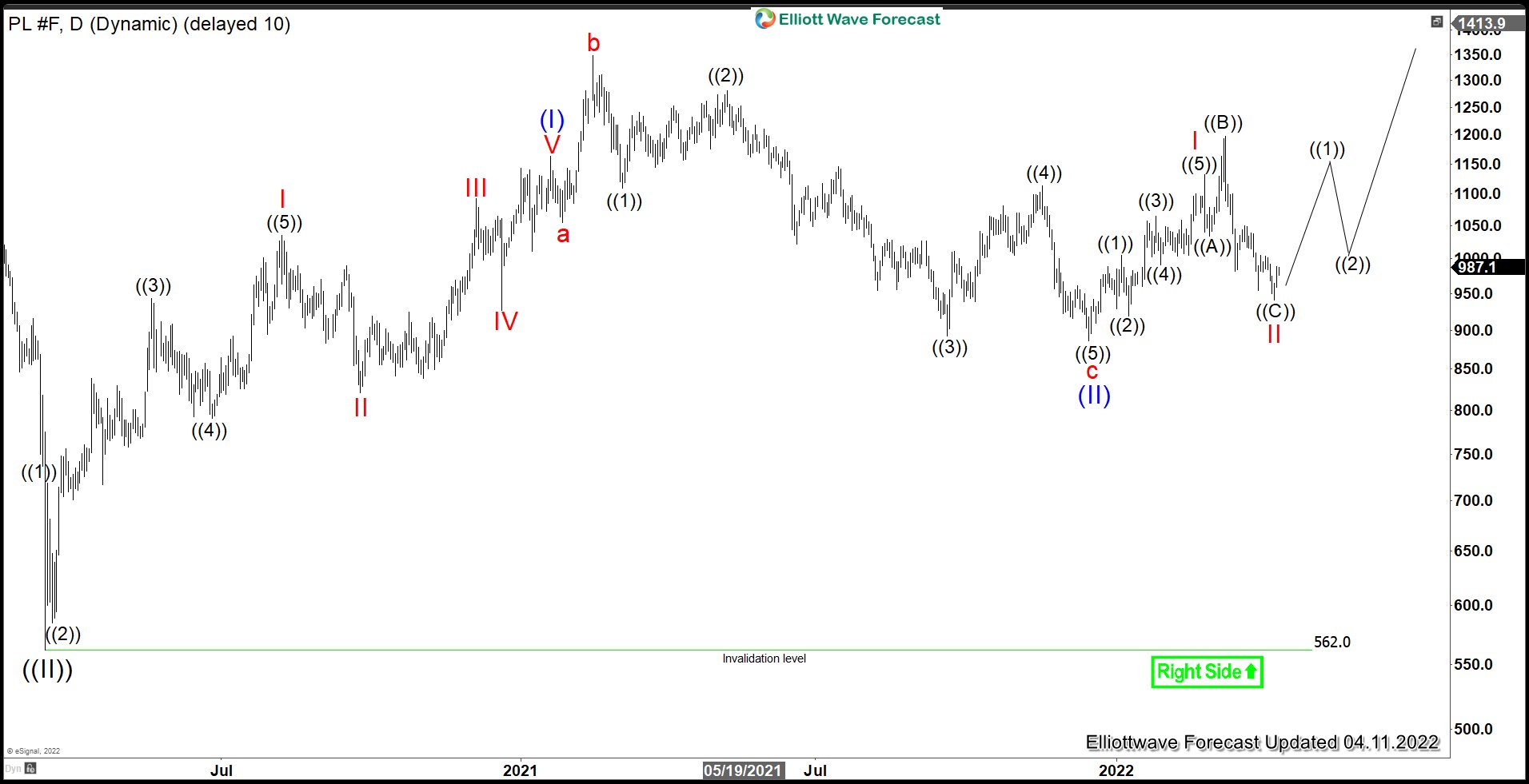

Platinum Daily Elliott Wave Chart

The daily Elliott Wave chart above shows more details of the monthly chart. Per the count above, we can’t rule out another leg lower in wave c to end wave (II). This will be a correction to the cycle from March 2020 low. the potential support will be at 100% – 123.6% Fibonacci extension of wave a which comes at $631 -$739 as denoted with the blue box. This area, if reached, should see buyers and the metal can then resume to new high.

Platinum Daily Alternate Elliott Wave Chart

The daily chart above shows an alternate chart if Platinum does not make a new low below December 15, 2021 at $886. In the alternate scenario above, we can count wave (II) completed at $886 as an expanded flat. In this scenario, the metal should continue to see further upside without breaking below $886. Either way, March 2020 low is a major low in the metal and it should see further upside in coming years.

Source: https://elliottwave-forecast.com/commodities/platinum-elliott-wave-outlook/