Palantir Technologies (PLTR), Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The Commercial segment offers services to clients in the private sector. The Government segment provides solutions to the United States (US) federal government and non-US governments. The firm offers automotive, financial compliance, legal intelligence, mergers and acquisitions solutions.

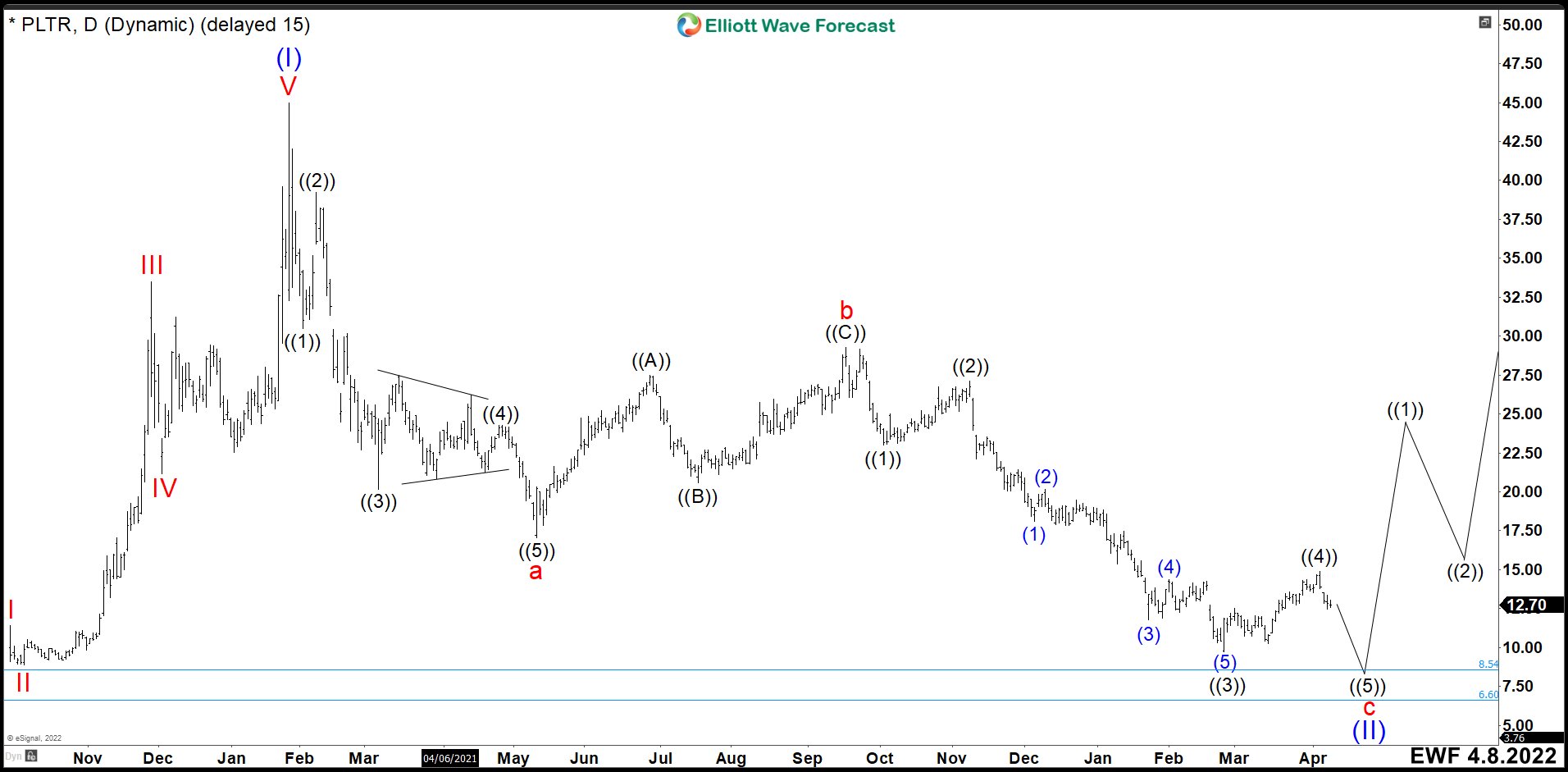

PLTR April Daily Chart

In January 2021, Palantir made an important peak at 45.00 and it has been going down ever since. We could see 5 waves clearly from the top where wave ((4)) is a triangle. This impulse we labeled as wave “a” ending at 17.09, more than 50% in losses. After that, PLTR bounce in 3 waves above of 38.2% Fibonacci retracement of wave “a” and resume to the downside. This correction ended at 29.29 dollars and we labeled as wave “b”. The next structure lower as wave “c” looks like is developing a perfect impulse. (If you want to learn more about Elliott Wave Theory, please follow these links: Elliott Wave Education and Elliott Wave Theory).

Wave ((1)) of the impulse ended at 23.02. A bounce correction as wave ((2)) completed at 27.11. Then PLTR fell abruptly in 5 waves reaching 9.74 dollars and we labeled as wave ((3)). Recently the corrective wave ((4)) has finished at 14.86 forming a flat structure and it has continued to the downside. Short term, we expect to continue lower to break 9.74 to complete wave ((5)). We should get divergence in this movement against the end of wave ((3)). This drop could reach 8.54 – 6.60 area to finish wave ”c” and also wave (II) as a zigzag structure. The rally from this area should result in the break of 45.00 peak in long term.

Source: https://elliottwave-forecast.com/stock-market/palantir-pltr-end-cycle/