$FXB British Pound ETF Elliott Wave & Longer Term Cycles

Firstly the British Pound Sterling tracking ETF fund FXB inception date was 6/21/2006. The bearish cycle lower from the November 2007 highs in FXB is the focus of this analysis. The British Pound Sterling has been the currency of the Bank of England since 1694. Considering that date was back before there was a US Dollar to compare with and data readily available suggests price was at 2.6440 in 1972. Thus I assume the trend remains down with an incomplete bearish sequence. Spot price in the GBPUSD foreign exchange was 1.0520 in 1995. Price was at 2.1161 in 2007 where it peaked and turned lower. This is where we will shift the focus to the FXB highs at 211.44 in November 2007.

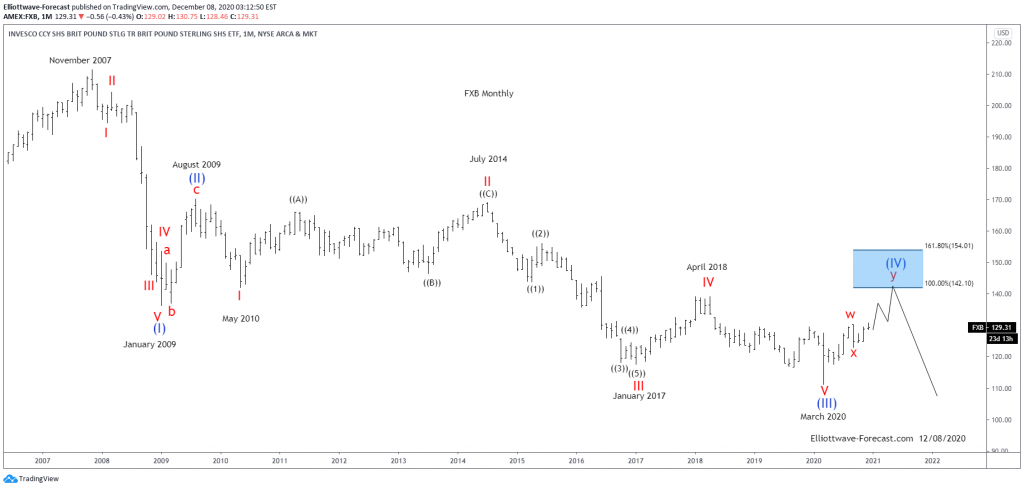

Secondly the bearish cycle from the November 2007 into the January 2009 lows was clearly an Elliott Wave impulse in 5 waves. From there into the wave (II) August 2009 high appeared to be three waves. From there into the May 2010 lows appeared best as an impulse wave I. From there into the July 2014 highs appeared to be a flat wave II. The analysis continues below the monthly chart.

Thirdly the turn lower from the July 2014 highs appears to be an impulse lower into the January 2017 lows that ended wave III. Price appeared to print a double three into the April 2018 wave IV highs. From there it appears a wave V of (III) completed in March 2020.

In conclusion : The instrument is currently correcting the cycle from the August 2009 highs. While above the September 2020 lows it can see the 142.10 area. Afterward the instrument can see some further weakness toward the 90 area before at least a larger degree bounce higher toward 170 to 180 if not back above the November 2007 highs.

Source: https://elliottwave-forecast.com/stock-market/fxb-british-pound-etf-elliott-wave-longer-term-cycles/