In this technical blog we’re going to take a quick look at the Elliott Wave charts of GOOGL, published in members area of the website. The stock is trading within the cycle from the March 1009.6 low. Proposed cycle can be still in progress as impulsive structure. In further text we’re going to explain Elliott Wave Forecast.

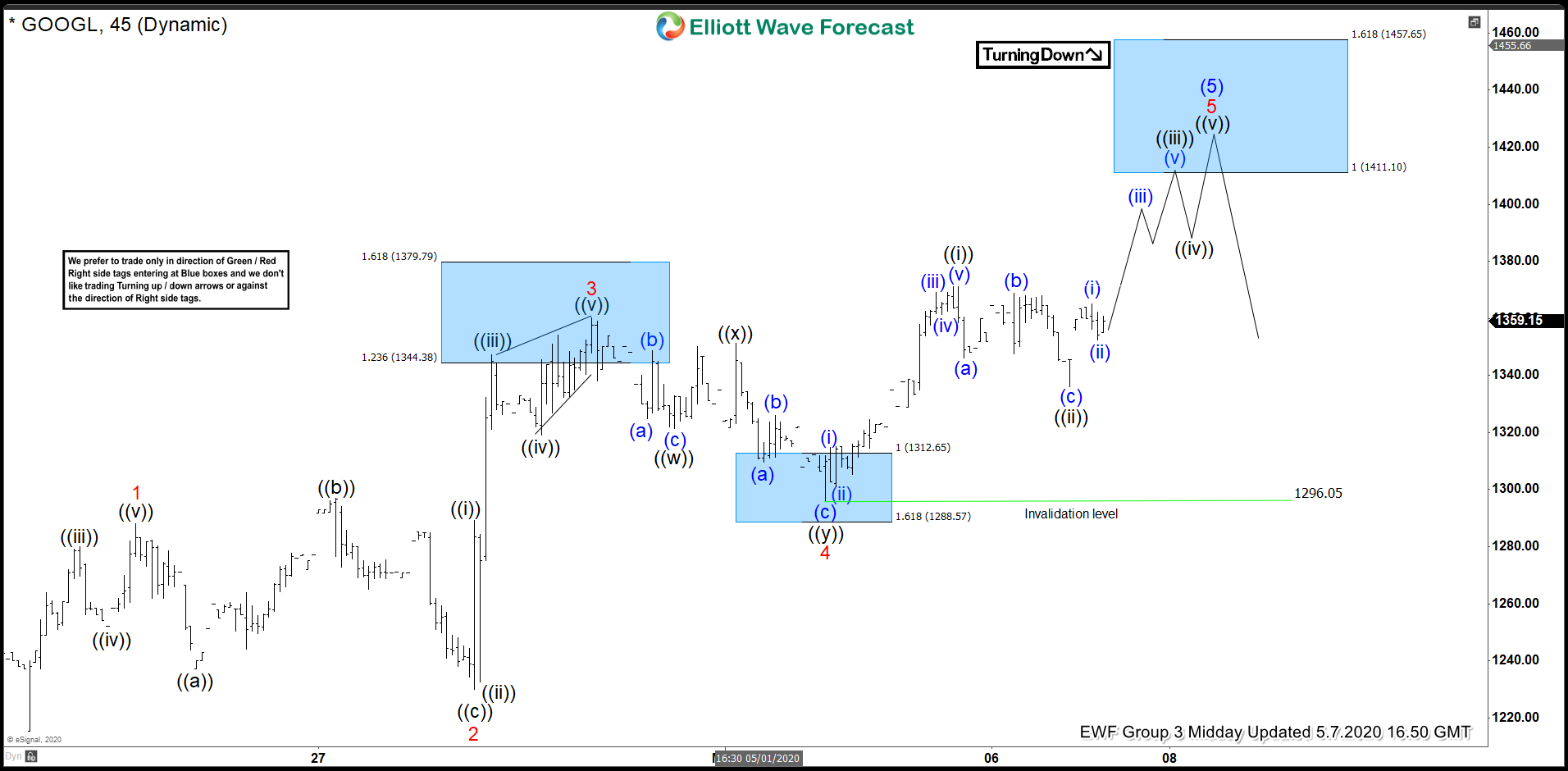

GOOGL 1 Hour Elliott Wave Analysis 5.7.2020

The price found buyers at previous equal legs area 1312.65-1288.57 and break toward new highs. As far as 1296.05 pivot hold, the stock has scope to extend higher toward 1411.1-1457.65 area where it can complete 5 waves up in the proposed cycle. We expect to see pull back 3 waves pull back from marked blue box before further rally resumes.

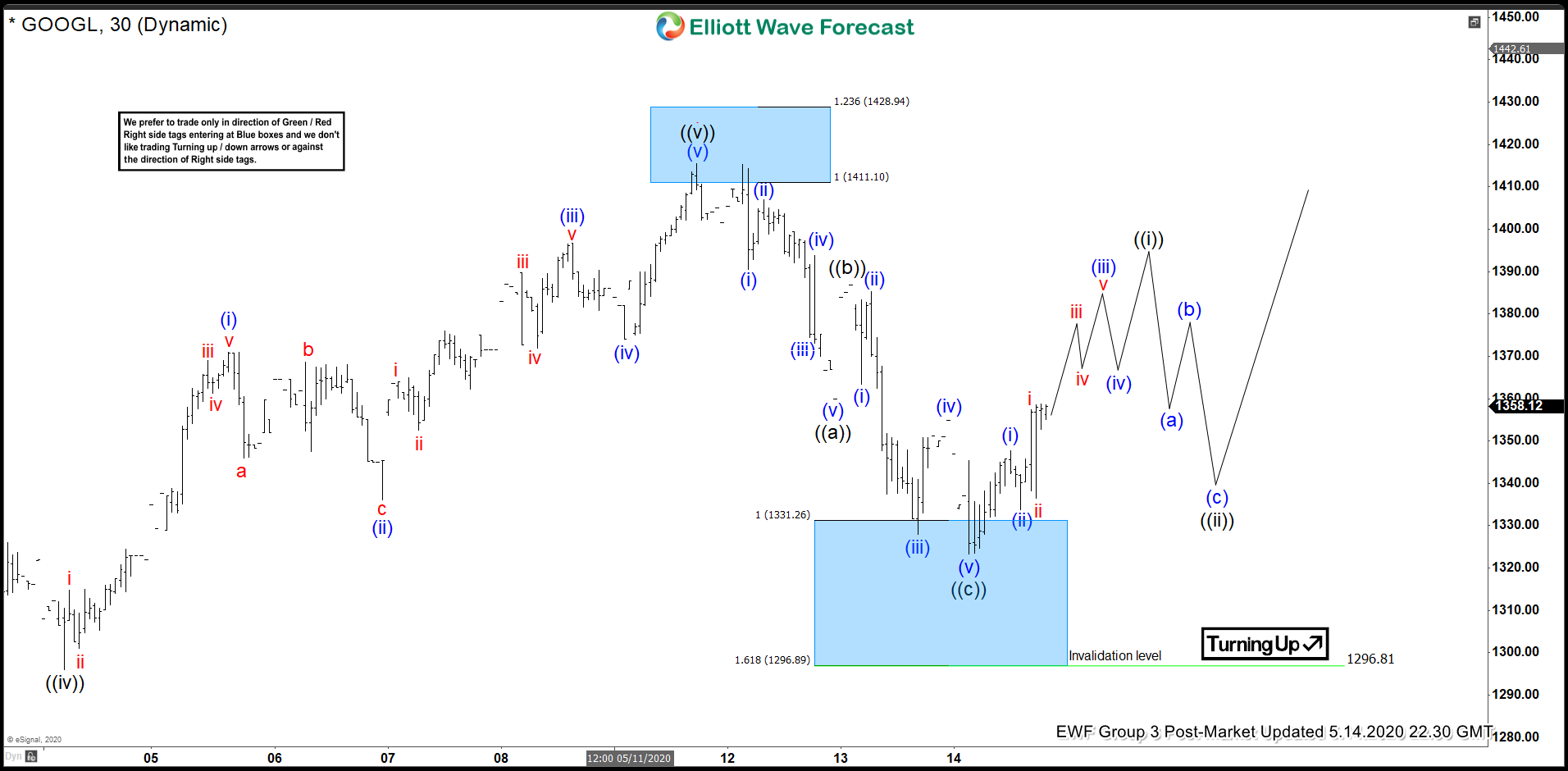

GOOGL 1 Hour Elliott Wave Analysis 5.14.2020

GOOGLE made extension up toward our target zone and found sellers as we expected. We got 3 waves pull back that unfolded as Elliott Wave Zig Zag pattern. The stock reached equal legs ((a))-((b)) at 1331.26-1296.89 and giving us turn. Current view suggests pull back is completed however we need to see further separation from the current low. We assume that new cycle has started. We expect to see 5 waves up from the 1323 low and pull back before rally resumes.

You can learn more about Elliott Wave Zig Zag Patterns at our Free Elliott Wave Educational Web Page.

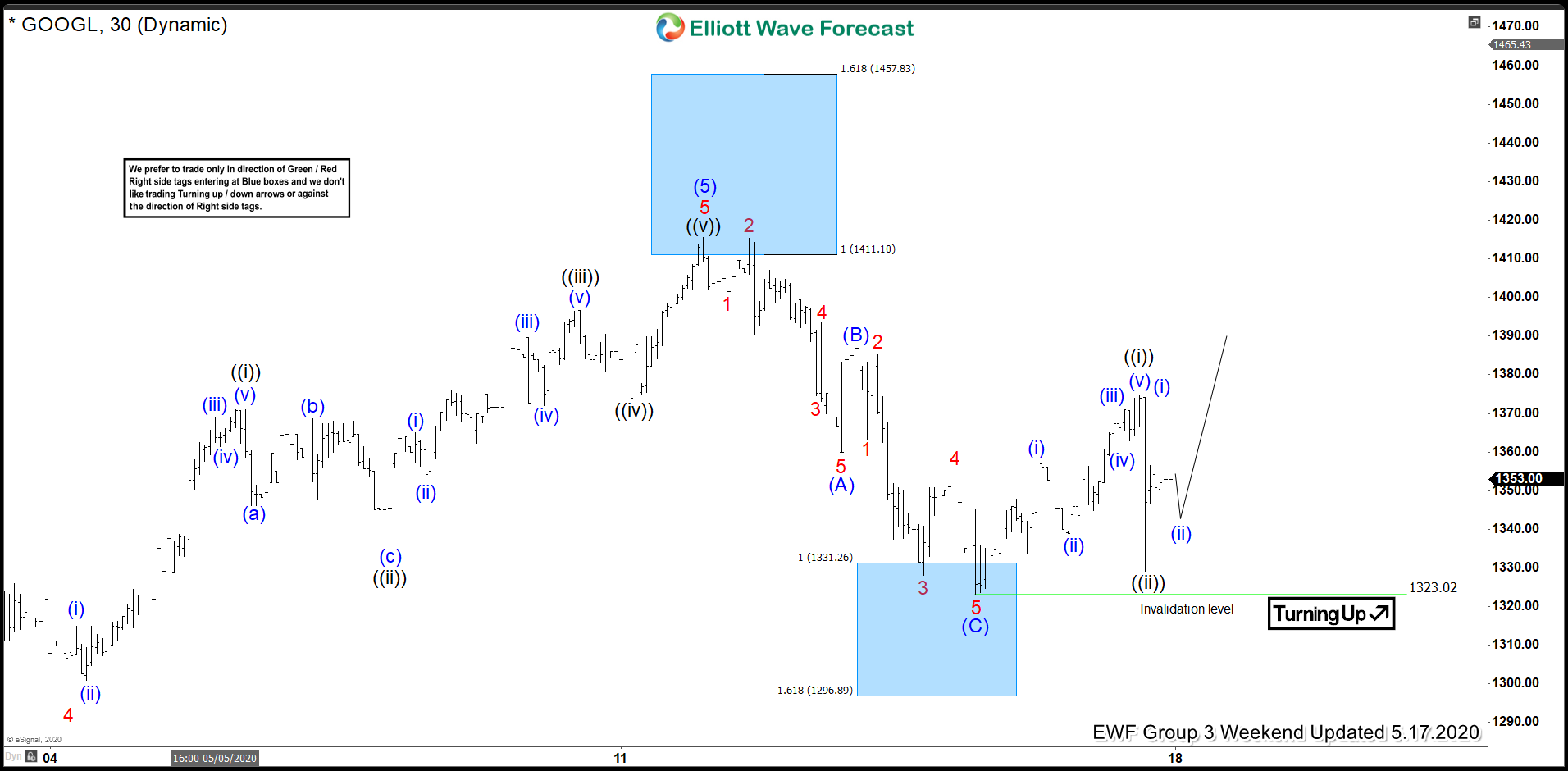

GOOGL 1 Hour Elliott Wave Analysis 5.14.2020

We got 5 waves up from the 1323.02 low. The price held above the low during the short term pull back. As far as the price remains above 1323.02, we expect further strength in the stock. We would like to see ideally break of May 11th peak to confirm next leg up is in progress.

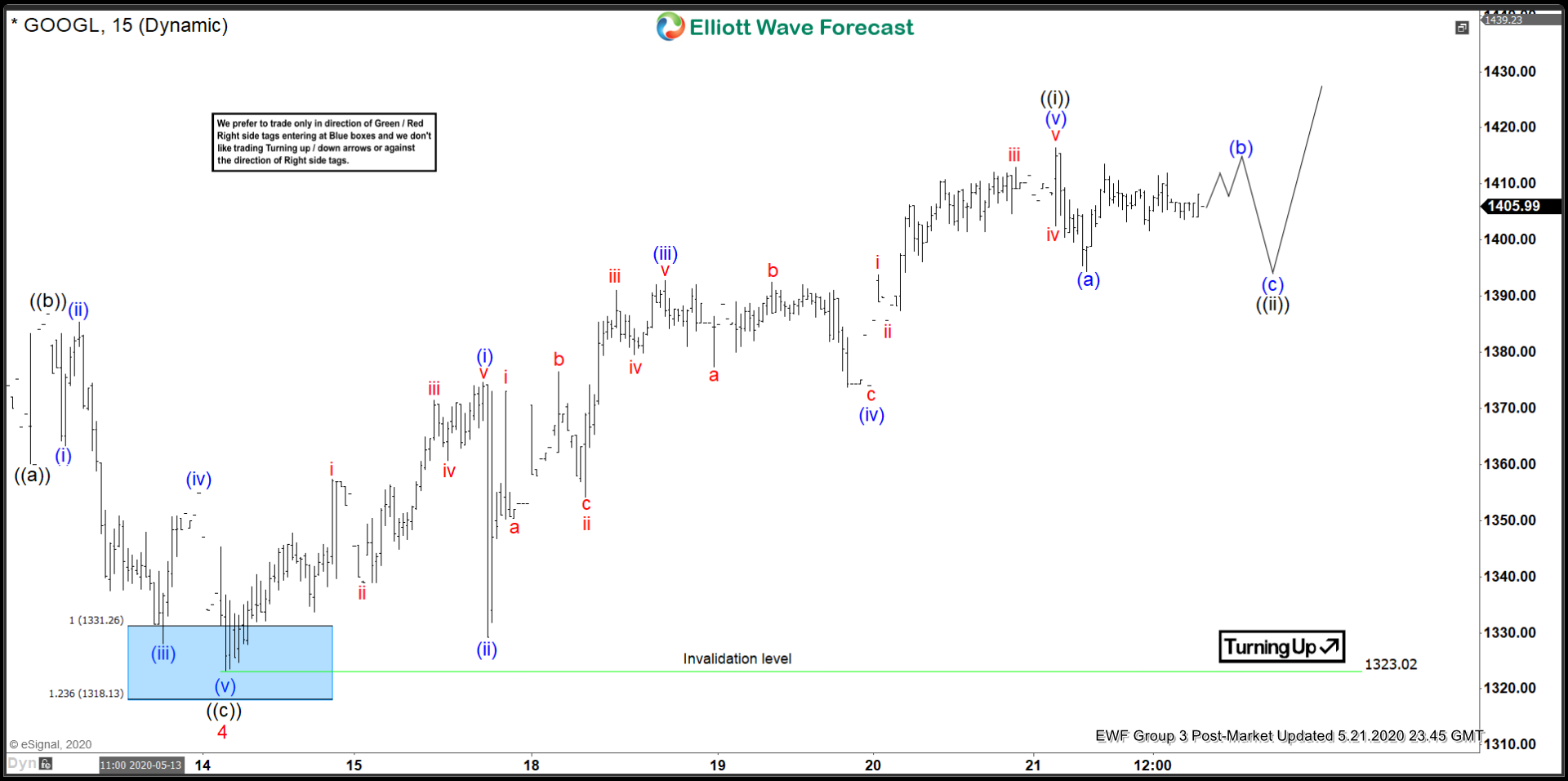

GOOGL 1 Hour Elliott Wave Analysis 5.21.2020

Eventually we got break toward new highs. Current view suggests the stock could have ended cycle from the 1323.02 low as 5 waves. We can be doing 3 waves pull back in wave ((ii)) before rally continues.

Keep in mind that market is dynamic and presented view could have changed in the mean time. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room. You can check most recent charts in the membership area of the site.

Elliott Wave Forecast