EURGBP Technical Analysis

On May 5/2020 I posted on social media (Stocktwits/Twitter) @AidanFX “$EURGBP will be watching for possible buying opportunities.”

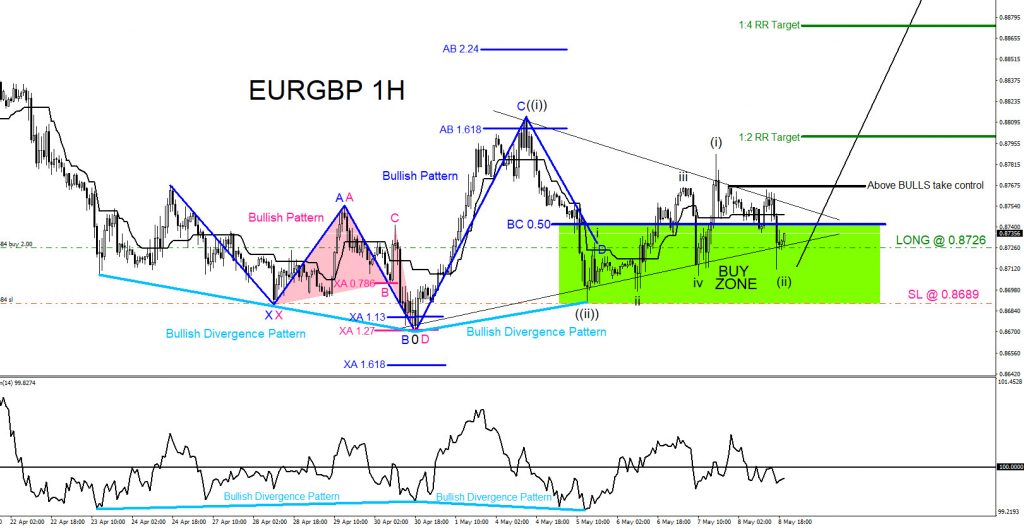

EURGBP 1 Hour Chart May 8.2020 : The charts below was also posted on social media (StockTwits/Twitter) @AidanFX May 8/2020 showing that a bullish pattern (blue) has formed and price has entered the buy zone looking for another move higher. Bullish divergence market patterns (light blue) and a possible bullish Elliott Wave impulse count was also visible which added more confirmation that a rally higher could happen. I called for traders to BUY the pair and to watch for price to break above the black trend line to confirm bulls have taken control. The bottom chart was posted May 4/2020 showing the same blue bullish market pattern calling for the move higher.

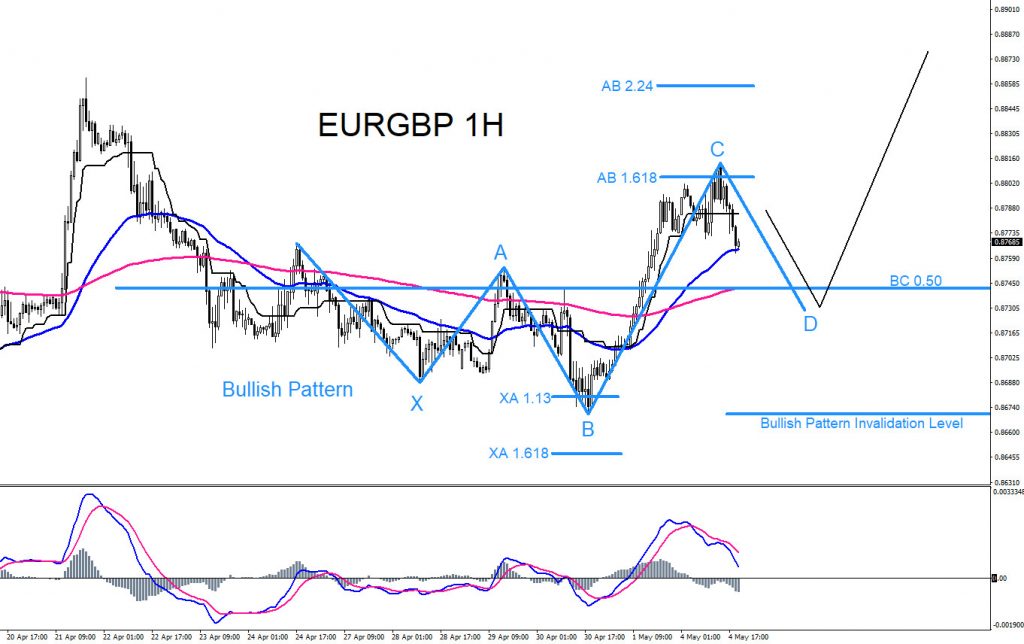

EURGBP 1 Hour Chart May 4/2020

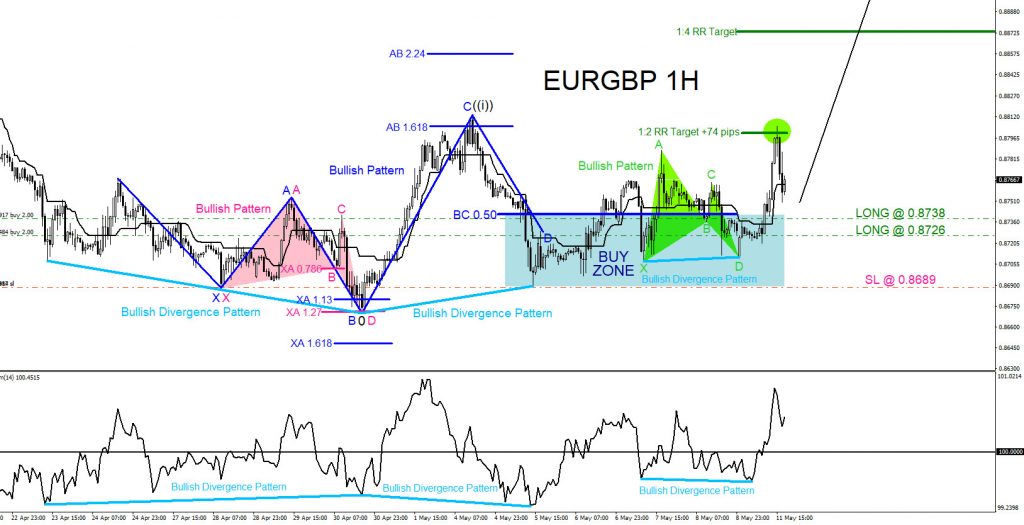

EURGBP 1 Hour Chart May 11/2020 : Chart below shows price breaks higher and broke above the black trend line level confirming bulls have taken control. BUY trades entered and expected a continuation of higher price action to happen in the coming days. Price has hit the 1:2 RR target but I continued to hold full positions for another round higher.

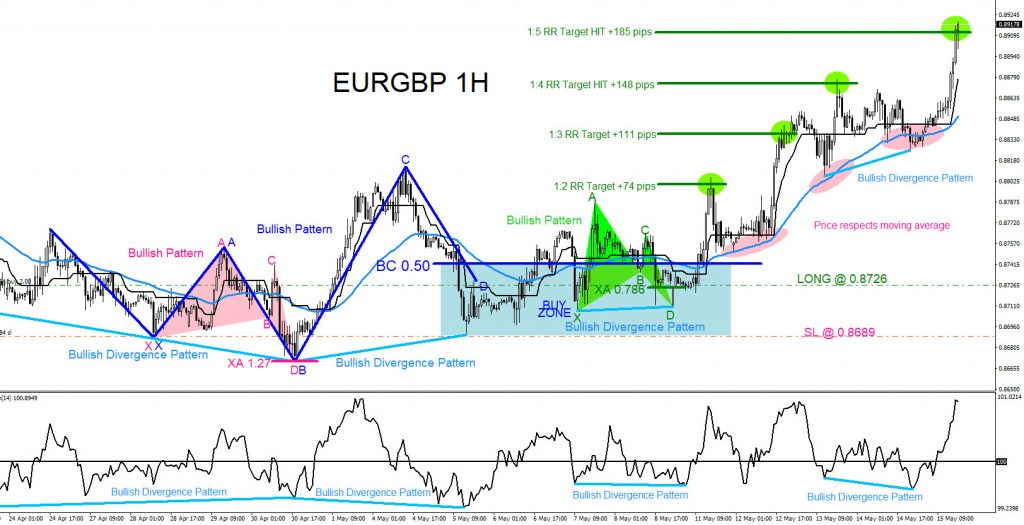

EURGBP 1 Hour Chart May 15/2020 : Price rallies higher, respects the moving average signalling bullish momentum and forms another bullish divergence pattern pushing price higher. Price reaches 1:5 RR target for +185 pips. If you followed me on Twitter/Stocktwits you too could have caught the EURGBP move higher.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on Twitter for updates and questions> @AidanFX or chat me on Skype > EWF Aidan Chan

*** Always use proper risk/money management according to your account size ***

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Stocks and ETFs) in 4 different timeframes and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Chat Room. Our clients are always in the loop for the next market move.