In this technical blog, we are going to take a look at the past performance of EURNZD, 1-Hour Elliott wave Charts that we presented to our members. But before looking into the Charts, we need to understand the market nature first. The market always fights between the two sides i.e Buying or Selling. We at Elliott Wave Forecast understand the Market Nature and always recommend trading the no-enemy areas. We called those no-enemy areas which are reflected as blue box areas on our Charts. They usually give us the reaction in favor of market direction in 3 swings at least. Now, let us take a quick look at the EURNZD Charts and structure below:

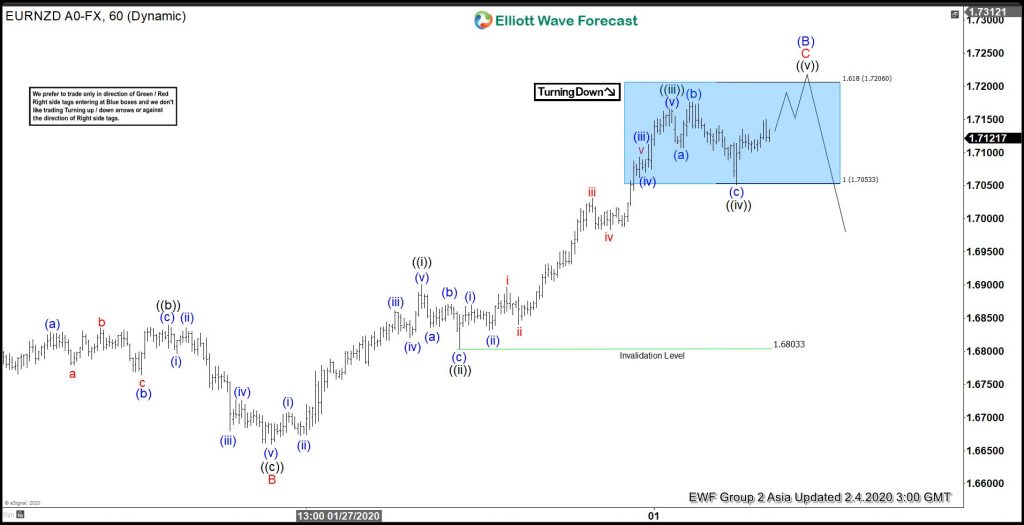

EURNZD 1 Hour Elliott Wave Chart

The Decline from October 2019 peak unfolded in 5 waves impulse structure thus suggested that it’s a continuation pattern. Therefore, wave (B) bounce was expected to fail in 3 or 7 swings bounce to do another 5 waves lower to complete the 5-3-5 structure. Above is the 1 Hour Elliott wave Chart from 2/04/2020 Asia update. In which the rally from December 31, 2019, low unfolded as a zigzag structure in a lesser degree cycle. When wave A ended at 1.6920 high, wave B ended at 1.6659 low. Wave C managed to reach the no enemy area at 1.7053-1.7206 100%-161.8%Fibonacci extension area of A-B. From there, the pair was expected to resume the next extension lower or to do a 3 wave reaction lower at least.

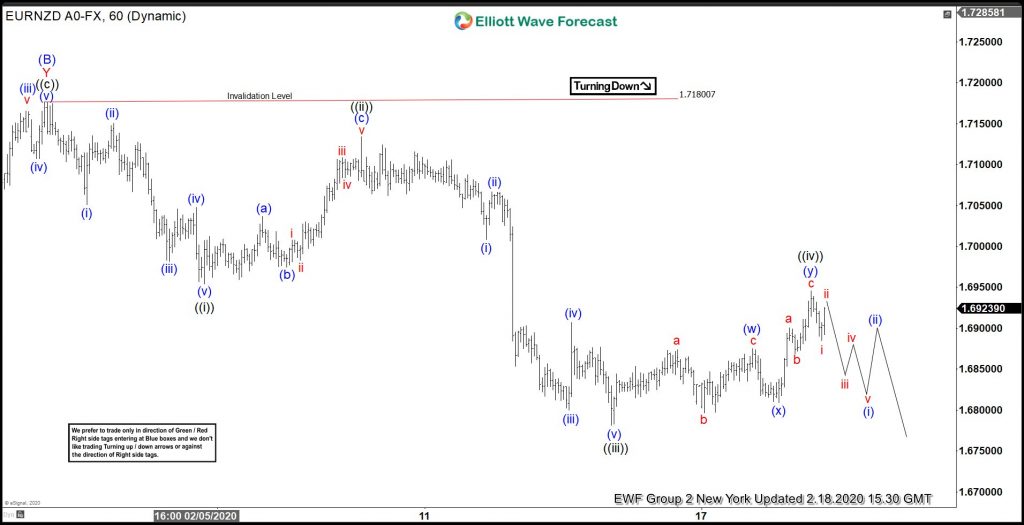

EURNZD 1 Hour Elliott Wave Chart

EURNZD 1 Hour Elliott Wave Chart from 2/18/2020 NY update. In which the pair is showing reaction lower taking place from the blue box area ( no enemy area). Allowed our members to create a risk-free position shortly after taking the short positions as per Elliott wave hedging. Near-term, while bounces fail below 1.7180 high the pair is expected to resume the downside. However, a break below December 31, 2019 low (1.6587) would remain to be seen to confirm the next extension lower to avoid double correction higher.